Coatue’s annual conference was held last week. I guess the invite got lost in the post. Thankfully Coatue shared their state of the markets deck here, and discussed the deck on the excellent BG2 podcast here.

Coatue’s combined public & private market strategy gives them a compelling viewpoint to contextualize trends within the VC market. The core themes are the size of the AI opportunity and speed of AI adoption.

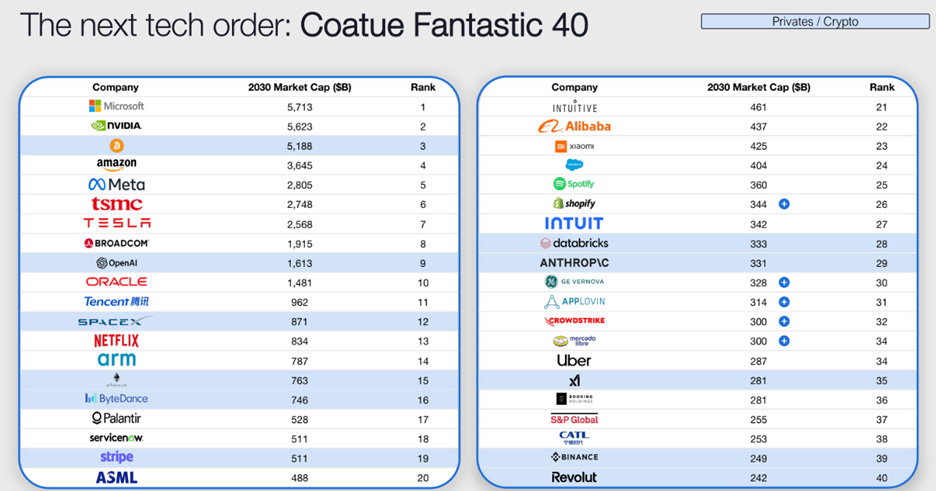

They also created an index of their own, the Coatue Fantastic 40, which ranks the expected market caps in 2030 of the fastest growing tech companies (Figure 1, excluding companies with expected multiple contraction, so Google/Apple are notable absences).

The inclusion of private companies & crypto here is a big nod to the blurring of lines between public / private markets (and potentially a subtler nod to the recent launch of their public/private interval fund).

Figure 1. The Coatue Fantastic 40 - ranked by projected 2030 market cap (slide 101)

This forward-looking list led to a vibrant internal discussion at SignalRank about our own view of what the private markets will look like in five years time. This post covers our top 10 predictions.

At the end of this post, we also thought it would be fun to ask our favorite LLMs their own view of what the VC ecosystem will look like in 2030.

SignalRank’s ten predictions for the 2030 VC ecosystem

1. The first trillion dollar private company

Based on market cap, SpaceX & OpenAI would be within the top 30 companies in the S&P 500 if listed today (see Figure 2, which excludes Chinese companies). These two are each larger by market cap than each of Coca-Cola, GE, Cisco, Salesforce, Chevron, Disney, McDonalds, American Express, AT&T, Goldman Sachs, etc.

Figure 2. Ranking of top 10 private companies in the S&P 500 by market cap

These companies should have gone public years ago. But the IPO has lost some of its allure for generational companies, in the face of deeper private capital markets, more liquid secondary markets and increased regulatory scrutiny for public companies.

It is not too much of a stretch to envisage one of these companies increasing in value by just 3x to become the first $1tn private market company.

2. The arrival of the uno-corn, the one person billion dollar company

The leveraging of AI tools is enabling companies to achieve scale with much smaller developer teams. In March 2025, Y Combinator reported that 25% of startups in its Winter 2025 batch had codebases that were 95% AI-generated.

This new development model has enabled revenue per employee to rocket (Figure 3) and the time to reach $100m ARR to contract (Figure 4).

Figure 3. Revenue per employee for top AI startups

Figure 4. Years from $1m to $100m ARR

These trends led to Sam Altman discussing in this interview when to expect a radical aspirational idea to become reality: the arrival of the first one person $1bn company. We wrote some more thoughts on this idea here.

3. A Tier 1 VC will go public

As multi-stage GPs scale asset accumulation, they increasingly resemble corporations and not artisanal partnerships. The logical conclusion is for these venture asset managers to go public, enabling superior access to capital, liquidity and smoother generational handover.

General Catalyst is said to be exploring its options (while a16z is rumored to have been flirting with the idea). This echoes a similar development in private equity in the last 20 years.

4. Passive indices will achieve 1% penetration of new US VC raised

Our belief is that the private markets will increasingly resemble the public markets, with the development of passive index funds alongside existing active managers.

Passive fund AUM overtook active AUM in the public markets for the first time in 2024 (Figure 5). The development of passive indices for private markets is in its infancy.

Figure 5. Active vs passive AUM ($tn)

The NVCA estimates that 538 US VC funds raised $77bn in 2024. SignalRank on its own aims to raise $150m per year. It should be reasonable to expect to see ~$1bn raised for passive strategies per year.

5. 50% of 2021 zombiecorns will still not have raised an up round (but will not have died either)

In Redpoint’s annual market update, they demonstrated how 72% of 2021 unicorns had not raised an up round in the last three years (Figure 6). It feels reasonable to assume that this number remains above 50% for the next five years.

There is a clear distinction in the VC datasets between companies created pre or post LLM. The pre LLM paradigm for company building no longer attracts VC capital. Yet many of these 2021 unicorns raised so much capital (and have cut costs for the new market reality) such that the reports on their expected death have been greatly exaggerated. But no IPO, no M&A, and no PE interest. Many are stuck.

Figure 6. Redpoint’s review of 2021 unicorns

6. There will be an AI correction

It’s called a hype cycle for a reason.

There is consensus (always dangerous) that AI is the next big technology platform. The big question is around timing. We wrote previously here about how early it is in the AI era.

Folks are starting to compare 2025 AI valuations to 2021 dynamics. It feels like we are some way off some of the 2021 behavior. No-one is spending $69m on an NFT just yet.

But there is still an abundance of optimism when it comes to AI’s potential. See Figure 7, a characteristically understated slide from a recent SoftBank presentation (unclear whether or not this is to scale).

Figure 7. SoftBank’s Evolution of Humanity

We are in the midst of the largest capital allocation to any single technology in human history. The vast majority of this capital will be incorrectly allocated. A correction must ensue at some point (even if the overall long-term trend is correct).

7. Retail overtakes endowments in terms of new allocations to VC

Endowments have historically represented 15-20% of VC capital. Their acute exposure to new political and economic realities (including the denominator effect, limited DPI & new taxation proposals) is leading to a rethink in investment strategy & allocation.

A counterbalancing development is the emergence of new alternatives products offered to retail investors by the world’s largest financial platforms. BlackRock’s Larry Fink’s annual letter envisions the democratization / indexation of alternative investments. He recommends moving from a 60/40 stocks/bonds portfolio to 50/30/20 stocks/bonds/private assets.

Bain expects private wealth & SWFs to account for approximately 60% of growth in alternative AUM over the next decade (Figure 8).

Figure 8. Global alternatives AUM

8. Geopolitical & economic instability will drive regulatory reform to accelerate VC allocation

In the 1970s, the perceived threat to the US from Japanese investors & semi-conductors led to the relaxation of the “prudent man rule” under the ERISA. This in turn allowed pension funds to allocate assets into VC & PE for the first time, enabling the US to reclaim influence in the innovation economy.

We anticipate that heightened geopolitical & economic instability today is likely to lead to similar developments in the US & beyond. The lack of economic growth in the UK already led the government to push UK pension funds to allocate up to 5% of assets into private markets by 2030 (~$60bn capital).

External threats (real or perceived) could act as an additional catalyst for governments seeking to drive capital into the most innovative parts of the economy.

9. An AI fund (with the AI as the decision-maker) will be on the Midas list

This is probably too punchy given that Midas list is so backward looking (with the 2025 list including investments made 10+ years ago). A more realistic projection is that a data-driven fund has completed an investment by 2030 which will propel the fund to a future Midas list.

We wrote here about the rise of data-driven investing in VC which mirrors a similar development in the public market over the last fifty years. An AI is now making angel investments (supposedly) all by itself. It is not a stretch to expect AI to expand into leading VC rounds itself (despite what Marc Andreessen says on this matter).

SignalRank is a quant AI strategy actively deploying today but we do not lead rounds.

10. Top 10 funds will consistently absorb 50%+ of all VC dollars

The barbelling of VC will continue. Pitchbook illuminated how nine funds took $35bn of US VC capital last year, half of the total raised. Andreessen Horowitz raised 11% of all US VC capital last year.

The Q4 2024 NVCA Pitchbook Venture Monitor makes for sober reading for emerging managers with only ~20% of VC capital now going to emerging managers. While ever more challenging for emerging managers to raise capital in general, we expect the solo GP trend (primarily spin outs) to continue to thrive.

We also anticipate this barbelling to occur at the company level. The number of companies funded each year will continue to decrease from 35-45k at its ZIRP peak to roughly half that number. Yet the average check size will increase at each stage. The winners will continue to absorb ever more capital.

What do the LLMs predict for VC in the next 5 years?

It is interesting to compare our human projections above with those generated by the LLMs. Here are the links to our prompts & responses on ChatGPT, Perplexity, Claude & Manus.

Most of their predictions feel bland and perfunctory (citing the proliferation of AI, growth of non US ecosystems, rise of ESG, etc). In short, AI slop.

Having said that, these are all predictions. We can return to this post in five years time to compare our predictions. By then, the stochastic parrots may indeed have become thinking machines.