There needs to be a vibe shift away from the phrase ‘vibe shift’. It already sounds tired.

And it’s only a phrase that has had currency in the last four years (a lifetime in the memetic era) after pop culture commentator Sean Monohan created the phrase in 2021 by identifying three distinct cultural zeitgeists from hipsters onwards. Each epoch had a distinct aesthetic, and the shift between eras was swift (nicely broken down in this article).

This framing clicked in the post pandemic world and has subsequently been applied to various domains from geopolitics, media, and beyond.

This is a long way of saying that there has been a vibe shift in tech. The advent of a new platform technology (AI) at a time of higher interest rates (leading to tighter capital markets) and greater geopolitical instability will do such a thing.

This table is our attempt to capture some of these rapid changes seen within tech & VC in recent years. Individually each change is notable, collectively they form a vibe shift.

Figure 1. SignalRank’s summary of the vibe shift

The idea of the one person $1bn company (if we’re coining epithets, the “unocorn” or “unacorn” perhaps) is the most emblematic of these changes. It is becoming the north star for the latest generation of ambitious founders, a radical aspirational idea that could only be realized with the power of AI tools.

The first notable public discussion of the one person $1bn company was in this interview last year between Reddit co-founder Alexis Ohanian and OpenAI’s Sam Altman. Here’s Altman:

“In my little group chat with my tech CEO friends, there’s this betting pool for the first year that there is a one-person billion-dollar company, which would have been unimaginable without AI — and now [it] will happen.”

How will the creation of a one person $1bn company happen?

We see three key changes to startups that could enable the vision: 1) AI tools that enable scale, 2) a shift in working culture and 3) an aversion to normcore VC.

Scaling

Vibe coding, a phrase coined by OpenAI’s Andrej Karpathy in February this year, refers to a concept a coding approach that relies on LLMs, allowing programmers to generate working code by providing natural language descriptions rather than manually writing it. He had already proclaimed in 2023 that the “hottest new programming language is English.”

It is the leveraging of AI tools through vibe coding that is enabling companies to achieve scale with much smaller developer teams. In March 2025, Y Combinator reported that 25% of startups in its Winter 2025 batch had codebases that were 95% AI-generated.

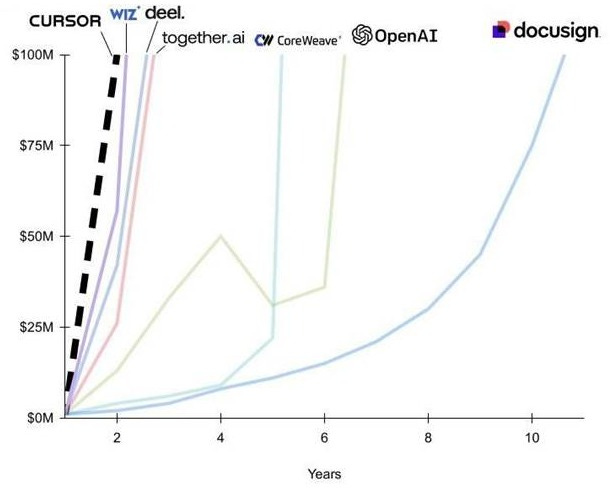

This new development model has enabled revenue per employee to rocket (Figure 2) and the time to reach $100m ARR to contract (Figure 3).

Figure 2. Revenue per employee for top AI startups

Figure 3. Years from $1m to $100m ARR

This creative destruction has also led to a sharp reduction in the number of US software development job postings (Figure 4). Indeed, the societal impact of Silicon Valley building towards a one person $1bn company ideal will be profound. But this topic is well beyond the scope of this post…

Figure 4 Software development postings in the US

Culture

The two product managers working at the pool were unfairly dunked on by the Internet in 2022. They might have been effective at their jobs, but they were perceived by trolls as being symbolic of an unserious remote working culture accelerated by the pandemic.

Elon Musk’s acquisition of Twitter transformed the perception of startup work culture. Bloated teams with generous wellness programs were out. Small squads of Stakhonivites pulling all nighters were in.

This has now percolated down to some startups. Mercor, which is in the SignalRank Index, has adopted the 996 (9am to 9pm, six days a week) culture which was popular in Chinese startups.

Funding

The default narrative for startups had been to raise additional capital to finance scale. This idea was captured in Reid Hoffman & Chris Yeh’s Blitzscaling book where speed is favored over efficiency even in the face of uncertainty.

This financing mode has led to a high number of failed unicorns. Redpoint’s Logan Bartlett shows how 72% of 2021 unicorns have not raised an up round in the last three years, left in “Zombieland”.

Bootstrapping, raising no external capital, has returned to be the paragon of virtue for startups. Second best is the concept of seedstrapping where founders raise one round only, while leveraging AI to deliver such productivity gains that cashflow can sustain future growth.

Kudos to Indie’s Bryce Roberts for calling this shift early, iconoclastically burning a unicorn on video last year. This was a Jerry Maguire like move – not a memo, a mission statement. Indie continues to deliver on this differentiated positioning, recently funding Rocketable, a one-person holding company of profitable software companies.

Others are starting to adapt the venture capital product for this new reality. Sahil Lavingia offers a standard $100k for 10% of profits to allow vibe coders (in gaming) to go fulltime.

Similarly, when it comes to exits, as we described in our previous post, the way that founders are seeking liquidity is shifting. IPOs are no longer necessarily the default goal.

Final thoughts: the strange death of the millennial worldview

This post has painted a picture of an aspirational startup model. A major caveat is that this new model is exactly that: new and as of today not achieved.

At SignalRank, we continue to see 100+ post Series A / pre Series B opportunities per month. And these are typically companies created since the launch of ChatGPT in November 2022. Companies are largely still hiring people and raising capital to scale.

Nevertheless, as this post has articulated, funding realities may not have changed yet but the vibes / perception certainly have.

There is in fact a much broader conversation to be had about how these cultural shifts in startupland are reflecting broader societal changes. The tech-optimist globally minded millennial-led worldview is dead. Millennials used to naively believe that social media would create a more connected and open world, while digital platforms would enable flexible employment and the sharing economy would deliver alternatives to ownership. Now, Gen Z has arrived in the workforce in a more unstable geopolitical world with higher interest rates and a new platform technology. Everyone (and their startups) is a prisoner of their own time.

What replaces the millennial-led worldview remains unclear. Perhaps it will be Gen Z’s cynical pragmatism, a return to older forms of conservatism, or an entirely new paradigm we have yet to see. But one thing is certain: the era of the millennial ideal is over.

The changes in startup culture are simply reflecting this strange death of the millennial worldview.

Great read.

'Companies are largely still hiring people and raising capital to scale."

Henry Shi's AI leaderboard includes only (except for Telegram) companies that offer new Ai tooling. Can they sustain their revenues over the next 5yrs? Questionable.

Can other type of companies join this leaderboard or is it only those buidling the current tools? Time will tell.

My thinking is that none of these companies are different in the way they run their business. The AI NATIVE business archetype is not yet born.