The shifting sands of LP land

The current fog of economic uncertainty could lead to a meaningful shift in the make up of venture capital’s LP base, and ultimately to how VC is offered as a product to investors.

Endowments, which historically contribute 15-20% of VC capital, are particularly exposed to the new economic & political realities, requiring a rethink in investment strategy & allocation.

A harbinger of change is Yale, who pioneered the ‘endowment model’ with high alts allocations, allegedly selling $6bn in its PE portfolio in secondaries for the first time.

Some factors affecting endowments include:

Denominator effect: The immediate change has been the impact of the new tariff policies on public portfolio valuations, potentially exacerbating the denominator effect (with allocators deciding they may be too overweight in private markets).

No DPI: Liquidity has been delayed for LPs as slated IPOs are postponed (including Klarna & StubHub). This prevents the recycling of capital back into the ecosystem.

Capital absorbed to cover expenses: proposed cuts to federal funding and higher mooted taxation (under the proposed Endowment Tax Fairness Act) would force universities to divert more capital to operating costs. This would worsen the denominator effect, and liquid strategies would surely be prioritized going forward.

As ever, and more than any individual issue (which on their own could be absorbed and planned for), it is the climate of uncertainty that is having the most corrosive effect on confidence. And this uncertainty goes beyond tariffs.

Universities are under a full frontal assault by the administration; Leo Terrell, from the Department of Justice declared on Fox News that “we’re going to bankrupt these universities… [which should] lawyer up, because the federal government is coming after you.” Hardly a conducive environment making new 10+ year illiquid bets.

A counterbalancing development is the emergence of new alternatives products offered to retail investors by the world’s largest financial platforms. BlackRock’s Larry Fink’s annual letter envisions the democratization / indexation of alternative investments. He recommends moving from a 60/40 stocks/bonds portfolio to 50/30/20 stocks/bonds/private assets.

Last week also saw the announcement of a collaboration between Blackstone, Vanguard & Wellington to allow individual investors to tap into private and public markets. Similarly, Charles Schwab has just added alternatives for retail investors.

It is likely that these alts platforms will initially focus on more established private asset classes, especially private equity, real estate and infrastructure (instead of VC). These platforms are also likely to accentuate the concentration of capital in branded managers because these platforms will be looking to place capital at scale and into managers with strong track records (in other words, not emerging managers).

At the same time, Sovereign Wealth Funds (“SWFs”) are likely to play a more meaningful role. Andreessen Horowitz is rumored to be in the market to raise a $20bn fund. Is this just a repositioning of the $40bn fund that A16Z had been marketing to Saudi Arabia’s PIF last year?

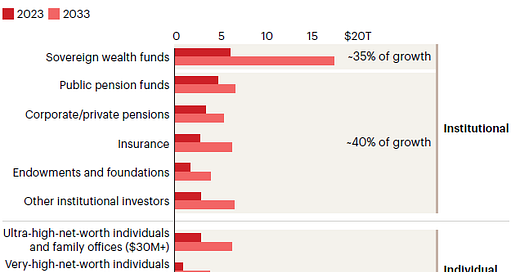

The growth of private wealth & SWFs was highlighted in Bain’s recent private equity report from earlier in the year. Bain expects private wealth & SWFs to account for approximately 60% of growth in alternative AUM over the next decade (Figure 1).

Figure 1. Investment into alternatives by source of capital

There is a question then about whether this is a recalibration, or a retreat, by traditional LPs. Yale’s proposed $6bn secondary sale would bring a ton of dry powder and reinvestment risk - where does this recycled capital go? Which other asset class offers such compelling theoretical returns?

Sapphire’s Beezer Clarkson argues that the current challenges faced by LPs are “a liquidity issue, not a sentiment issue.” Indeed, the opportunity set for venture capital should expand as companies stay private for longer and the potential TAM for AI applications continues to increase.

Still, the entry of new types of LPs could impact the way that VC is offered as a product. Altimeter’s Meghan Reynolds argued here that the percentage of LP capital into “traditional 10 year funds will be less. What’s filling the gaps? Evergreen funds, secondary funds, co-invest, direct strategies…” She goes on to argue that SWFs can eventually skip funds and just do deals direct (eg the MGX in UAE); likewise individuals can skip funds with all of the SPVs offered by banks.

VC is changing. Venture firms need to rethink not just who they raise from, but how their LP base influences what they’re offering.