It seems like almost every day at the moment that an asset manager is announcing a new partnership to make alternatives go mainstream. BlackRock’s acquisition of Preqin in the summer fired the starting gun on this rush to alternatives, by signaling an intention to index private markets. Last week saw Apollo & State Street launch a “private credit” ETF (well, up to 15% of the portfolio can be private). This week saw BlackRock announce a partnership with Partners Group for an all-in-one private markets product.

Why is this happening? And what does this mean for venture capital land?

The primary driver is the continued outperformance of private markets relative to public markets (on average, and net of fees; Figure 1). With companies staying private longer, asset managers need greater allocations to alternatives to access growth.

Figure 1. Private equity time weighted returns vs public indices

This interest in alternatives also comes at a particularly challenging time for asset managers who are experiencing no growth, fee compression and rising costs. Alternatives represent growth and higher margins, even before the greenfield opportunity of selling alternatives to retail investors.

VC will benefit from the halo effect of this drive into alternatives. Increased interest in alternatives should lead to additional capital spilling into the venture industry. Yet the focus of large asset managers in alternatives is predominantly in private equity, hedge funds, private credit, infrastructure & real estate. Venture capital is typically an afterthought because it is sub-scale & more cyclical (read power law reliant) relative to these other alternative groups.

For venture capital to benefit more deliberately and more meaningfully from this trend, VCs would need to create products which are low cost, deliver predictable returns and can scale. They also need to be accessible to retail.

Asset managers face increasing challenges

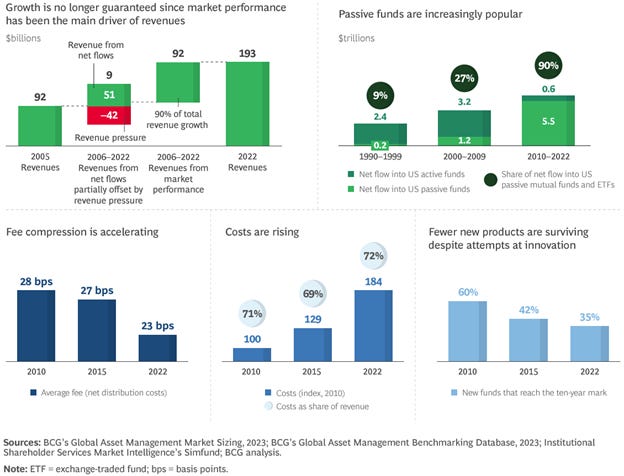

The asset management business has seen two decades of strong market performance & revenue growth. Yet 2022 felt like a turning point, as global AUM started to fall, and quickly, by 10% to $98 trillion. The combination of market uncertainty, fee compression, rising costs and technological change has led to a period of introspection at large asset management groups (Figure 2).

Figure 2. Five pressures show the need for transformation

Transformation is on the lips of asset management leaders. BCG published this excellent report last year on how asset management organizations should pursue the three Ps:

Profitability. Optimize costs throughout the organization, rather than just cut expenses.

Private Markets. Consider entering the alternatives space—which has high-growth opportunities—and offering private market products for retail and institutional investors.

Personalization. Implement (AI) technologies that make highly personalized client experiences and products, such as direct indexing, possible.

BCG advises that these three approaches can allow firms to thrive in the next decade. The whole report is worth a read but we’re going to focus on the private markets component.

Why alternatives are attractive

From an asset manager’s perspective, alternatives are an increasingly attractive strategy because 1) alternatives are growing rapidly, 2) alternatives attract higher margin products, and 3) retail investors represent an untapped pool of incremental alternatives investors. Let’s unpack each of these in turn.

1) Alternatives growth

Bain anticipates that alternatives will scale from $25 trillion under management in 2023 to $59 trillion by 2033 (9% CAGR for those interested; Figure 3). Bain argues that this growth stems from private assets “constituting a much larger market than public assets and offering potentially higher yields, diversification, and in cases such as real estate—a hedge against inflation.”

The trend towards companies taking longer to go public also plays a role, as investors want access to growth. This has been exacerbated by the fallow period of liquidity, with fewer companies going public or being acquired since 2021.

Figure 3. Alternatives expected to see strong growth

2) Higher margin products

The working title of this post was “fees, glorious fees.” Alternatives are a lucrative business. In 2022, alternatives represented 21% of global assets under management and 50% of global revenue in the asset management industry (Figure 4). 🤯

Figure 4. Alternatives represented 21% of AUM and 51% of revenue in 2022

BCG has also created a chart to demonstrate AUM growth by product, compared to net revenue margin (Figure 5). Alternatives represent both high growth and high margin.

Figure 5. Alternatives represent high growth & high margin

3) Retail opportunity

The cherry on the top for asset managers is the potential to expand alternatives into retail. The argument goes that endowments and institutions have done very well by allocating 25%+ to alternatives by following David Swensen’s Yale model. Why shouldn’t retail allocate a similar percentage to alternatives?

This idea has asset managers salivating. Alternative asset growth in the retail segment already outpaced institutions globally from 2012 to 2022. Bain estimates that retail investors’ interest in alternatives is set to grow further at 12% CAGR to 2032 (and ultimately represent 22% of alternatives AUM; Figure 6).

Figure 6. Retail investors’ share of private markets set to continue to rise

Technology, product innovation and regulatory reform are additional tailwinds in this drive to “democratize access” to alternative investments.

However, product packaging remains the biggest hurdle to reach the mass affluent. UHNWIs can tap into a broad suite of products, similar to institutions. Mass market retail investors require more liquid products with lower minimum investment requirements (Figure 7).

Figure 7. Asset managers need different products for different retail investors

Can venture capital benefit from this trend?

Venture capital has historically been a cottage industry with sub-scale investment products. On the face of it, VC does not appear to be a good fit for asset managers.

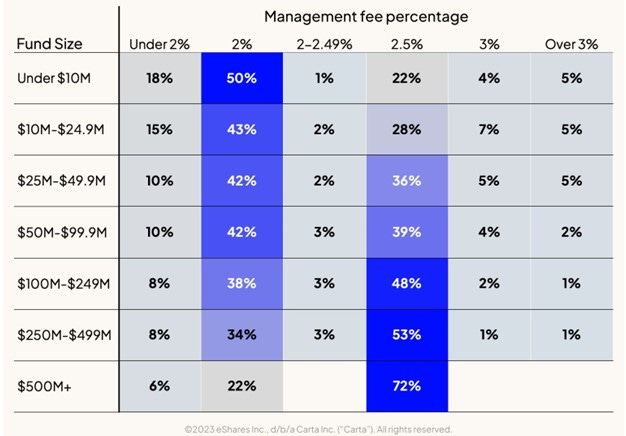

The smaller fund size has led to VC managers charging higher fees, sometimes higher than 2% per annum. 2.5% per annum is becoming more normalized, even for larger platforms (Figure 8).

Figure 8. Carta data on VC management fees by fund size

The other problem with fund size is that asset managers cannot allocate to the emerging VC managers (who historically have higher returns, as well as higher variance). Asset managers cannot jam a $100m check, or even a $25m check, into a $50m seed fund. Historically, large asset managers have not been able to access seed stage managers directly.

But VC is changing:

1. Product & fee stratification

At SignalRank, we have long argued that the private markets are going to look more and more like the public markets. We anticipate greater risk/return stratification in terms of product offerings (private market alpha vs. private market beta) with increasing divergence in fees. There will be a bifurcation in fee load between high-touch value add managers which can consistently deliver alpha, and passive broad-based indices offering beta.

In the same way that Renaissance can charge 5%/44% in the public markets, why can’t the best VC managers charge more? A16Z & Sequoia are already at 3%/30%.

Likewise, broad-based passive private market indices should trend towards lower fees. Today is very early in the history of indexing private markets. All private market indices (including SignalRank) are currently sub-scale and charging above market fees. Destiny XYZ currently charges 4.98% (including a 2.5% management fee). By contrast, Vanguard’s S&P 500 ETF costs 0.03%. There is some way to go for current private market indices.

At scale, SignalRank aims to offer its product at 50bps per annum (0.5%). We anticipate that this is where private market indices need to end up.

2. Scalable quality

Early stage venture capital as a high touch product is not scalable. Human investment partners cannot make more than 2-3 investments individually per annum. Early stage VC is artisanal, as access to the best early stage companies is built on human relationships. Bill Gurley argued that “venture capital unscalable. Production equals the time each partner has.” So the current set up for most VC funds does not allow for operational gearing. If you want to do more deals, you need to hire more people. A large team requires large management fees. What’s A16Z at these days? 500+ employees?

A quantitative approach can allow for scalability, but it does not in of itself ensure quality. Data-driven VC is becoming more and more popular as a way of reviewing opportunities at scale. At SignalRank, our back-tested model constantly tracks c.1,000 post A / pre B companies which we believe have signal, and it can identify with success the top 5% of highest potential Series Bs. We can identify companies which can achieve 5.0x+ MOIC from Series B with 30% success rate (compared to the market average of 10%). Great, but how do you access these companies in a way that reduces adverse selection?

Our pro rata access point significantly reduces adverse selection. The best Series Bs are competitive. If SignalRank were a Series B investor going through “the front door”, we would not get access to the top 5% of Series Bs. By financing the pro rata rights of existing investors, we can allow our investors to access quality at scale. Indeed, we are currently working with 200+ seed managers and reviewing 50-60 Series Bs opportunities per month to enable us to make 30 Series B investments per annum.

This scalable quality should be attractive to asset managers.

3. Structural innovation

VC funds are traditionally structured as GP/LP entities. And for good reason. This structure is well understood, aligns financial incentives, has clear legal protections & is tax efficient.

However, there is a movement to create VC products which allow for scalability as well as liquidity. These types of products are more likely to be of interest to asset managers & retail investors.

Ark Ventures & DXYZ are two recent examples (and they even had an amusing spat on X about the relative benefits of their different structures).

At SignalRank, we have talked before about how a listed structure can convert MOIC into DPI, allowing greater liquidity for investors. But we also believe that a listed structure is critical to a product becoming attractive to large asset managers. A listed entity creates an easy access point for asset managers & retail investors to latch onto. Just buy (and sell) the stock.

Retail investors & asset managers are looking for accessible products with better liquidity than the traditional GP/LP structure allows for.

Some final thoughts

It is exciting to see asset managers seek to capitalize on the growth opportunity in alternatives and private markets. For venture capital to benefit more meaningfully from this trend, we expect to see more product innovation & more new entrants who can offer scalability, high quality and low cost products.