Venture capital is no longer a cottage industry. Sequoia Capital long ago gave up its principle that “if we can’t ride a bicycle to [the company], we won’t invest.”

Venture capital has arrived as a global asset class, where investors are seeing venture as a component within their asset allocation strategies. VC’s potential for power law returns appeals to allocators. David Swensen’s Endowment model has become received wisdom, with ever increasing allocations to alternatives (including venture). KKR has perhaps been the most vocal asset manager in pushing for the Swensen approach for retail investors too, with “trillions” to be unlocked with retail investors moving to alts.

And yet average VC returns have been subpar. 50%+ of VCs return <1x DPI. 👀 Average VCs represent high costs for poor / non-existent returns for investors. Most LPs would be better off in the S&P 500. VC is a power law game at every level: power law LPs access power law GPs which access power law individual assets.

The lack of liquidity further masks underperformance. Proponents of private market asset classes like to argue that there is more valuation stability than in public markets. Quarterly / monthly valuations set by committees are preferred to the brutality of the public market every day. Yet Cliff Asness, co-founder of AQR, likes to describe this phenomenon as “volatility laundering” where the risk-return profile might not fully reflect the underlying volatility. To butcher Warren Buffett, it is hard to always know who is swimming naked when the tide goes out in slow motion.

If we want the VC ecosystem to continue to thrive and attract sophisticated institutional capital, what to do?

We see three major trends gathering pace at the bleeding edge of innovation within the venture industry to deliver superior returns for LPs:

Data-driven models

Liquid structures

Risk/return stratification

Together, these trends suggest a move towards an indexing approach within venture capital. We will consider each of these trends in turn.

1. Data-driven models

VCs have liked to argue that “data is the new oil”, for every industry except their own. The VC industry has ordinarily been reticent in applying data models to their craft. The defense for 2/20 fees & carry is a manager’s alpha from “proprietary deal flow” based on existing relationships and experience. This is reminiscent of the Upton Sinclair quote that “it is difficult to get a man to understand something when his salary depends on his not understanding it.”

The success of ChatGPT marked the widespread consumer adoption of AI. Allocators want to know how GPs are playing AI. If AI is disrupting other white collar jobs, then why not VC too?

The adoption of AI models in sourcing & diligencing VC opportunities is likely to become table stakes in short order (even for emerging managers). A good recent example was the launch last week of QuantumLight, a $200m data-driven VC founded by the Revolut CEO.

Earlybird’s Andre Retterath has now started to catalogue trends & tools in this space with his Data-Driven VC site, report & events. He listed SignalRank’s CEO, Keith Teare, as one of the top 20 thinkers on this topic in the 2024 report.

2. Liquid structures

The lack of liquidity in VC is well documented and is potentially the critical issue within VC. The current trend for companies to stay private for longer has been exacerbated by large scale M&A (e.g. Adobe’s proposed acquisition of Figma) being blocked by regulators and IPO velocity remaining depressed compared to historic norms. This prevents the recycling of LP capital back into future cohorts.

Liquid VC structures are nothing new. BDCs are an accepted product in the US public markets, while the UK has a number of listed VC products (from Venture Capital Trusts, such as Beringea & Octopus Ventures, to listed VC entities, such as Molten Ventures & Augmentum).

However, the need for liquidity has become more acute as the ZIRP era pulled forward fund cycles, leading to GPs to dream up ever more elaborate investment strategies to unlock LP capital. 3 year fund cycles contracted to 12-18 months. Hence the denominator effect when public markets fell in value.

KKR recently argued for the creation of evergreen structures within PE to allow for the compounding of returns over time. Yet we see the real catalyst for bringing liquidity to VC as the recent direct listing of Destiny XYZ, an index of 100 pre-IPO companies. Destiny (ticker: DXYZ) listed in March 2024 and currently trades at a 3x+ premium to NAV. Destiny is now seeking to raise up to $1bn for its strategy (even as its portfolio companies dispute Destiny’s ownership of stock acquired via forward contracts).

The performance of Destiny suggests two things to us: 1) there is demand from public investors for high quality private stocks, and 2) the SEC has blessed the legal route for VCs to go public themselves.

3. Risk/return stratification

VCs with 2/20 fee structures that deliver <1.0x DPI represent high costs and subpar returns for investors. We see the VC market evolving to mimic the public markets with more sophisticated stratification of risk/returns. High quality active managers can command premium fees/carry, while passive lower cost indexing strategies can deliver superior net returns for most LPs.

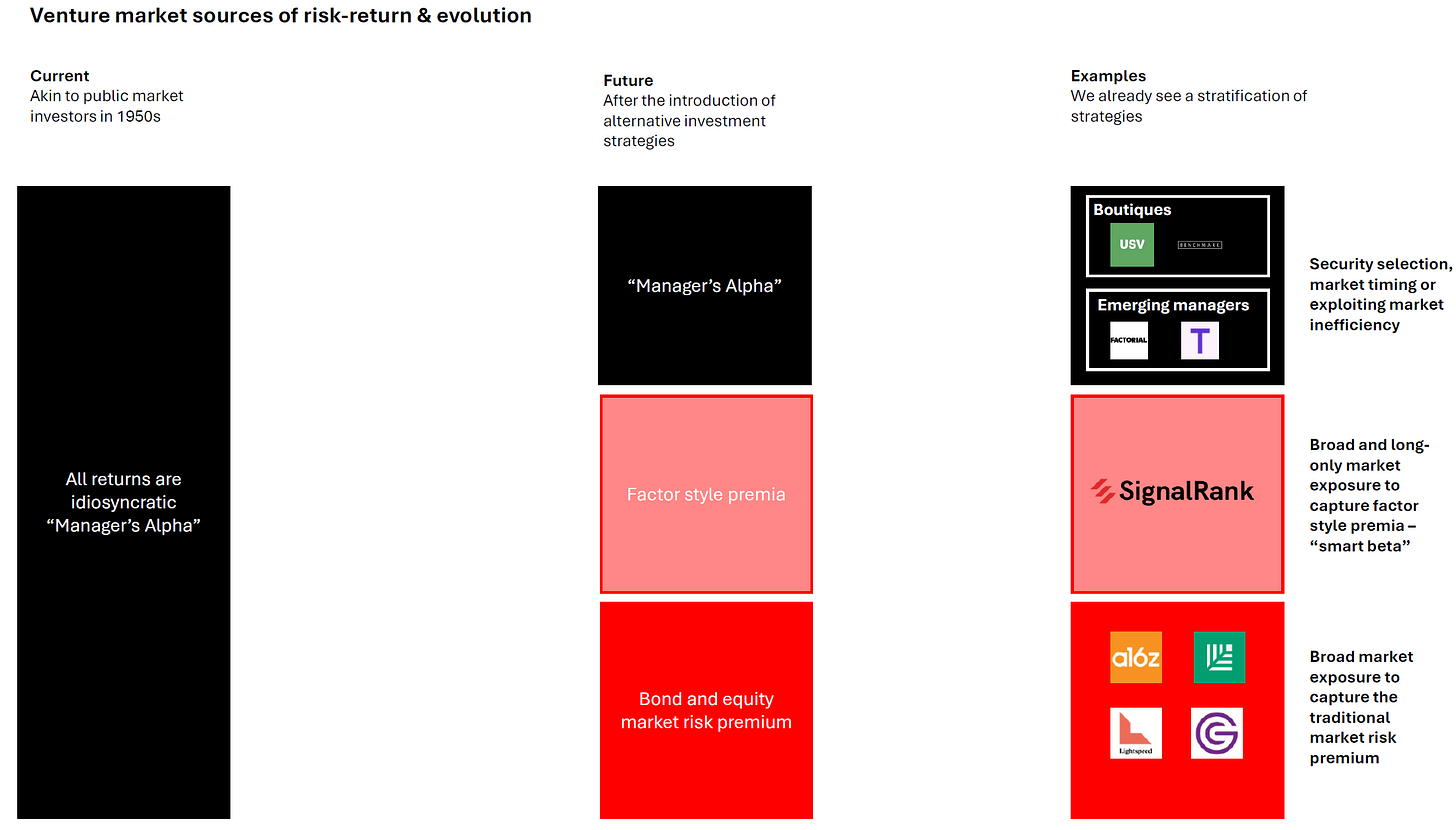

In the 1950s, public market investors believed all returns derived from alpha. This is now de minimis, as investor perceive alternative sources driving risk/return.

Figure 1. Public market sources of risk/return evolution

Source: SignalRank

In the private markets, LPs today focus on manager selection to drive returns (akin to idiosyncratic alpha in the public markets). We envisage that there will be beta products in the private markets too.

Indeed, we already see that the GP market has bifurcated between capital accumulators and emerging managers. Capital accumulators can offer high quality beta, while we argue that emerging managers can represent alpha.

The largest brands in venture capital have already switched to capital accumulation mode. The combined recent $16bn fundraise of A16Z ($7.2bn), General Catalyst ($6bn) and Khosla Ventures ($3bn) equals almost exactly all VC capital raised by emerging managers in the US in 2023.

The current market uncertainty further favors the biggest brands, as a flight to perceived quality has taken place. You don’t get fired for hiring Goldman Sachs. You don’t get fired for investing in A16Z / Sequoia. Yet smaller, nimbler managers can represent alpha. The largest outperformance for LPs tends to come from emerging managers.

Figure 2. Evolution of risk/return in VC

Source: SignalRank

We believe that these beta products are best placed for mid to late stage VC. The fundamental essence of early stage VC is artisanal. It can’t scale. Successful venture requires a deep understanding of people and their projects. This human element ensures that the early stages will require a hands-on, nuanced approach that leverages industry expertise and interpersonal skills. The best of these VCs who consistently generate alpha (DPI, not TVPI) should command premium fees for their bespoke, high-touch investment strategies. A16Z & Sequoia are already at 3/30. Why not reach for Renaissance Technologies’ 5/44?

Some concluding thoughts

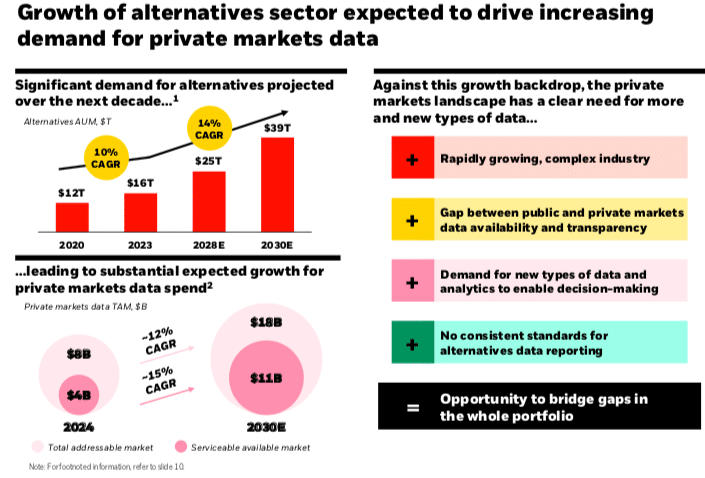

We see the emergence of indexing strategies as the natural conclusion of these three trends. Indices combine data-driven strategies with liquidity & risk/return stratification.

We are encouraged by BlackRock’s recent acquisition of Preqin to enable BlackRock to index the private markets backed by Preqin’s data. Here is BlackRock’s Larry Fink commenting on the acquisition:

“We envision we can bring the principles of indexing, and even iShares [BlackRock’s exchange-traded funds business], to the private markets,” he added. “We anticipate indexes and data will be important future drivers of the democratisation of all alternatives, and this acquisition is the unlock.”

Figure 3. BlackRock’s private market strategy

Source: BlackRock 2023 Investor Day

SignalRank shares BlackRock’s vision. Our focus is to be the data-driven liquid index for high quality VC assets.