What is SignalRank?

Newsletter - January 2023

I am writing this newsletter for a few reasons.

If you have engaged with SignalRank over the past year and want to know how it has developed

If you know me from reading, That Was The Week and are curious about SignalRank.

If you have heard about SignalRank and are curious about what it does or need an overview

If you are an overseas or US-qualified investor and want to start understanding SignalRank.

Then this is for you: If you have thoughts, please use the chat feature in the Substack iOS or Android app to engage.

Happy 2023

Keith Teare and the entire SignalRank Team

SignalRank is building the first systematic platform for investing in venture-backed companies. A systematic investor removes all subjectivity from decision-making and relies solely on data-determined decisions for allocating capital to opportunities.

To be successful in this, it is necessary to

Select the best companies to invest in as early as possible.

Get access to those companies to deploy capital.

Produce returns better than other investors focused on the asset class in all market conditions.

Systematic Selection Engine

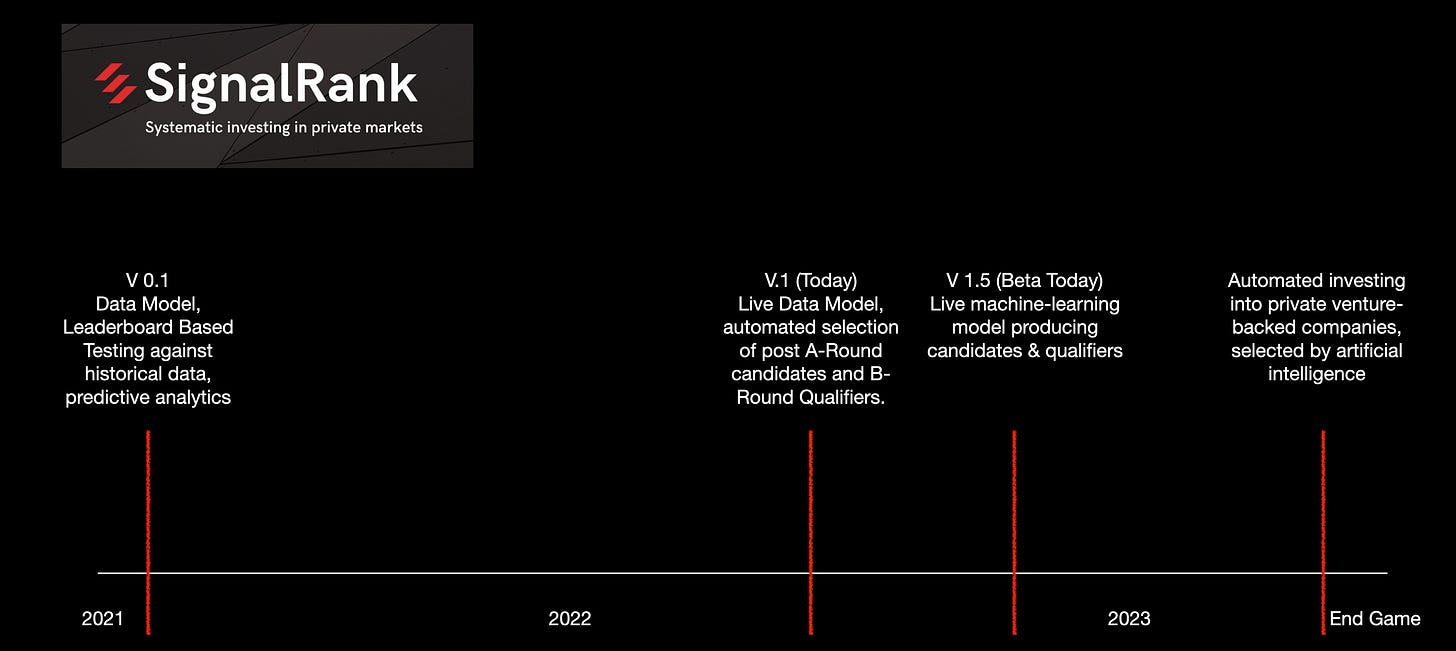

After developing the original idea and building v0.1 of a model in 2021, in 2022, we took it to a different level. The founders are confident in satisfying all three requirements, although this is only the starting point.

SignalRank has developed a live model that selects the best Series B venture-backed companies. It sits on top of almost 50 million data points across practically a million funding events.

The current version is v1 of the platform. It uses a proprietary model. The model profiles investor behavior up to the Series B of a company. By focusing on investor behavior, the model optimizes for companies where the best seed and Series A investors combine with the best Series B investors, all of whom excel at due diligence. This approach captures the investors’ appraisal of the company’s performance and potential. The model learns by constantly scoring and ranking the best investors against outcomes.

The model works in two phases. First, it profiles all new pre-seed, seed, and Series A funding events. It reviews 100% of funding rounds to select the companies with a strong signal. It rejects about 80% of Series A companies at the Series A stage, seeing the remainder as having some indications of being a future winner. These selections are called SignalRank Candidates. There are currently 1,300 candidates that have completed a Series A and have yet to do a Series B.

Taking its 2019 work as an example, the model rejected 76.2% of all companies at Series A (3,589 of 4,715), leaving 1,126 candidates.

Then it rejected all but 127 of 1,126 at Series B, rejecting another 88.7%. So, by Series B, it had denied 4,588 companies or 97.3% of the 4,715 starting number. The model selected 127 at the Series B round. We call these selections the SignalRank Index.

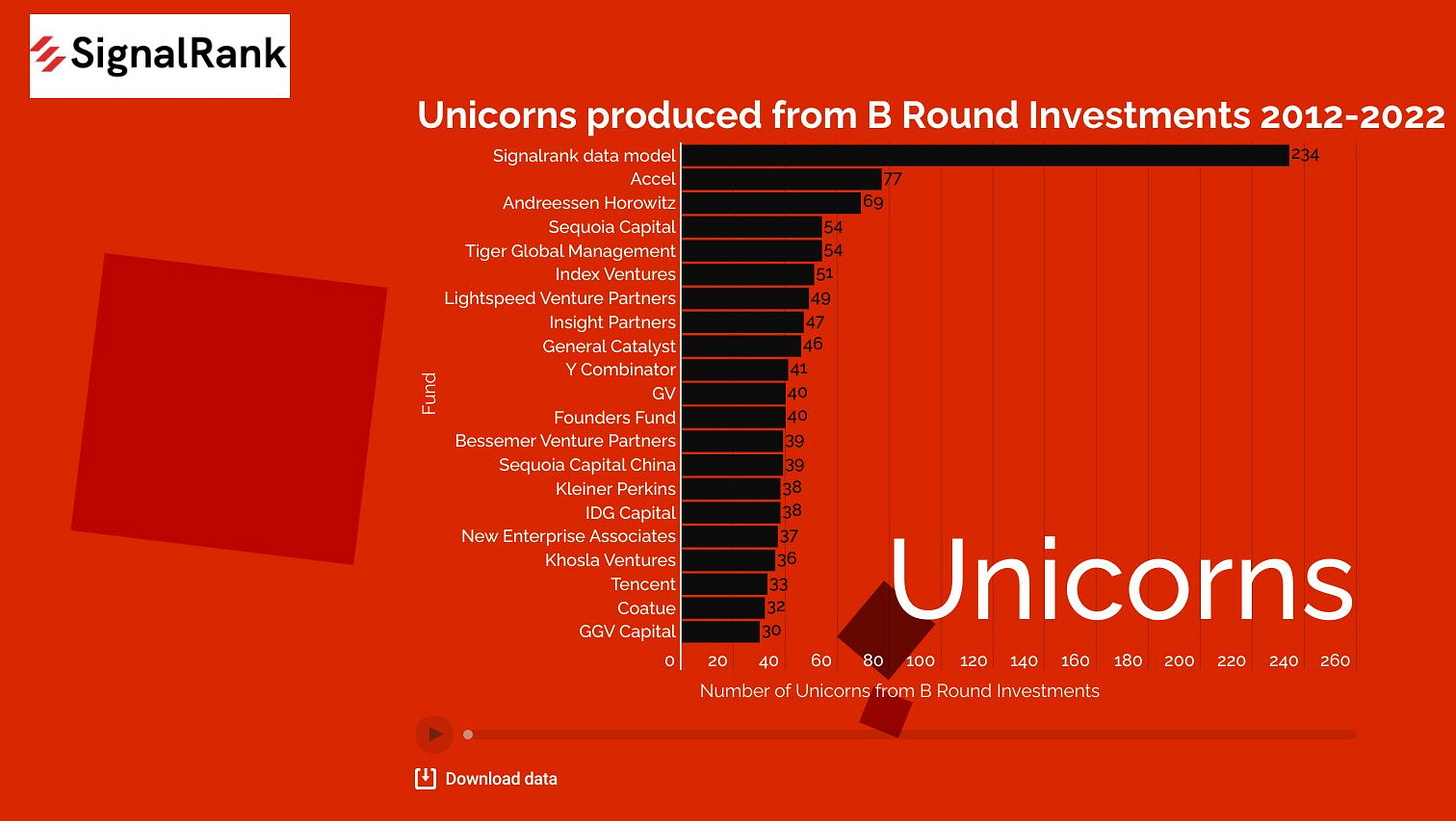

SignalRank’s model has studied funding rounds for each year since 2012. It has selected 1,127 companies since then, 203 of which it chose in 2022. The 5-year multiple of invested capital (MOIC) from Series B averages 6x. There are two hundred thirty-four unicorns in this selected batch since 2012.

Looking at 2019, but this time only at the Series B Stage, the model is an excellent Series B investor.

There were 2,087 Series Bs in 2019. Six hundred sixty-four companies attracted a Series B investor that the model rates as high performing. There are 100 such high-performing investors currently. But only 144 of the companies had all the signals required for selection by the model. The model, therefore, rejected 93.1% of all Series Bs. And 78% of Series Bs led by a top 100 B investor were also dismissed.

These 144 recommended companies entered the SignalRank Index.

All Qualifying Series Bs each year result in the company joining the Index. The complete Index is a list of all 1,127 companies selected since 2012. The table below shows the number of Index entrants each year.

The 2022 Index cohort represents 9.6% of all Series Bs. The 203 selected raised $12 billion in Series B. This group will likely average at least 6x MOIC by 2027.

The ML model will be capable of learning and improving, creating an improved systematic investment platform for private companies.

It is important to note that the ML model is an exercise in adding features and improving for selected Series Bs. SignalRank’s Systematic Investment Platform is already entirely self-governing, making allocation decisions into Series Bs that the team at SignalRank executes. There is no human override.

People are Still Important

The model scores the decisions of the best seed, Series A and Series B investors. These investors excel at due diligence and at picking winners early. By scoring the investors, the model has created a proxy for finding the best companies because that is what those investors consistently achieve.

Modeling the best human decision-makers and applying their scores to Series Bs, the SignalRank model rests on the shoulders of the best early-stage human investors. It is not replacing them. Early-stage investors are the raw material that enables the model to pick likely winners at the Series B stage.

SignalRank aims to use profiling and scoring to complete a 100% AI-driven systematic investment platform. SignalRank’s model is already top-performing compared to other Series B investors, and it will improve as it evolves to AI and learns what other signals make a good Series B.

The roadmap looks like this:

How the Model Performs

The live model performs very well. As noted above, it produced 1,127 recommendations between 2012-2022, of which 234 are currently unicorns.

Measured by how many unicorns it identified at the Series B stage, SignalRank’s model is the best-performing Series B investor over the last ten years.

The chart below ranks SignalRank against active Series B investors over that period, using unicorn production as the measure. The top-performing Series B investor after SignalRank is Accel Partners, which has 77 Unicorns. Here are the top 50 Series B investors since 2012 by that criteria.

SignalRank’s model has been in development for over two years. It is a baby by most standards. That it is already able to rank first, based on the unicorns it would have produced, is a beautiful start.

How Does SignalRank Gain Access to the Series Bs it Selects?

SignalRank accesses Series Bs by supporting earlier-stage investors to maintain their equity percentage in companies selected by the model. Take an imaginary fund manager who invested in a company at the seed stage, the Series A, or both. When Series B comes along, the manager wants to invest but has not reserved sufficient capital. Ironically this is almost always the case for their most successful start-ups. Let’s say the manager owns 10% of the company, and Series B is raising $40m. The manager must put $4m into the round to maintain ownership. SignalRank would let the manager know it is prepared to underwrite up to 100% of the $4m. This is called pro rata as a service. Today SignalRank has almost 50 partnerships with high-performing early-stage investors in hundreds of candidate companies.

The 1,300 candidates mentioned above have over 6,000 additional investors as equity owners in Series A. Most of those investors will be unable to write their follow-on or pro rata check. If the SignalRank selection engine recommends the company, then SignalRank would offer all Series A investors the opportunity to have it fund their pro-rata rights.

Based on the model, 300 to 400 of the 1,300 companies will qualify for SignalRank’s capital once the Series B term sheet is tabled. Together that constitutes $2 billion of follow-on capital allocation potential into qualified companies. The access arises from (a) the model identifying those companies and (b) a systematic investment platform guaranteeing capital to companies via partnerships with early-stage investors.

At scale, SignalRank will deploy up to $300m into the best 30 or so Series Bs annually recommended by the systematic investment platform.

SignalRank has already created an app where partners can see their portfolio and which companies are already considered candidates. The partners can also flag a company as actively raising a Series B, uploading the term sheet, and requesting capital. The model makes the yes/no decision to invest, and where it says yes, SignalRank can deliver funds via partners within five working days.

SignalRank’s investors also have a web app. Please open it and subscribe to it by clicking the image below. Or by scanning the QR Code with a mobile phone’s camera.

In the investor app, SignalRank investors can see the model’s recommendations. The app lists these candidates by geography, sector, and diversity profile. Crunchbase supplies SignalRank with funding-round data via a partnership, but the intelligence is from the model alone.

The model also supplies the app with previously qualified Series Bs and recommends Series C and Series D rounds from that set of companies. Once we go live in Q2, only shareholders will have access to this app.

SignalRank’s Structure and Path to Liquidity

Potential investors will need to understand our structure and path to liquidity.

SignalRank is a Delaware C Corporation. In other words, although it allocates capital to venture-backed Series Bs, it is not a fund.

SignalRank will raise capital to invest in Series Bs by selling up to 40 million preferred shares over time, initially priced at $25. The share price will rise as the assets appreciate.

Share purchases will only be available to overseas and US-accredited investors and organizations. There is a limit of 2000 US investors and an unlimited number of overseas investors.

Share sales will open each quarter, priced at the current fair market value, and spread over 2-3 years.

The shares will be available for sale starting March 2023.

The time it takes to raise the total amount will be determined by the demand for allocation to SignalRank AI’s selections and SignalRank’s access via partnerships.

Based on the number of shares and the initial price per share, SignalRank will not raise capital beyond $1 billion.

SignalRank will allocate capital to Series Bs beginning in 2023. Its business model involves structured liquidity. Unlike venture investors, it will sell 50% of its gains to create additional investment funds. This will occur around the three-year mark following a Series B. This means that in a ten-year window, capital will be redeployed at least three times, creating compounding returns.

Specifically, the cash generated from selling 50% of its gains in the third year will be redeployed into new, recommended opportunities for the next three years. SignalRank Corporation is a permanent capital platform attached to its data model.

The impact of selling and redeploying gains is that SignalRank will have sufficient capital for compounding returns and annual deployment of $300m once $1 billion of shares have been sold to investors. At the 10-year mark, the business model anticipates the company having a book value of 40x the $1 billion raised and a trading value above the book based on the growth characteristics of the assets it owns.

Public Listing

The final piece of the jigsaw for investors is that SignalRank will list as a public company at an appropriate stage, probably between 2027-2029. A public listing will allow shareholders to sell positions in SignalRank. When complete, this will address venture capital's most significant problem: illiquidity.

Publicly listing SignalRank has a secondary effect. It will allow retail investors to own shares and expand access to the fastest-growing private companies. Making the SignalRank Index available to retail investors is the end game. So, in addition to selecting the best companies, having access to their Series B rounds, and producing good returns in all markets, SignalRank plans to open up access to this asset class to retail investors.

The End Game

As 2023 begins, SignalRank will act on the model's recommendations and make systematic investments1.

A typical recommended Series B can support up to $5m allocation from SignalRank.

To summarize, the combined end goals are:

Selection of the best companies by AI

Access to those Series Bs by supporting partner’s ongoing investment preferences and rights, with a $300m annual allocation goal.

Returns that significantly beat the market, in all markets, redeployment of capital and compounding returns over three investment cycles in 10 years.

SignalRank’s data-driven model is a significant milestone for systematic investment in private markets. It promises to be the best Series B investor in the world.

Happy New Year from Palo Alto. I look forward to engaging with many of you in 2023 and beyond.

—

Keith Teare, CEO

About SignalRank

SignalRank is a systematic investment platform for the private markets. Our algorithms identify the highest potential Series Bs, which we access by supporting the pro rata rights of existing investors. With one investment into SignalRank, investors access an index of fast-growing private companies exclusively backed by the most iconic investors globally.

Our existing investors include Garry Tan (YCombinator CEO), Dan Rose (Coatue chairman), and Lip-Bu Tan (former Softbank board; Intel board).

This newsletter is not a solicitation or a recommendation to invest. If you are a qualified investor and are interested, don't hesitate to contact funding@signalrank.co so that your status as an investor can be determined.

For those unfamiliar with systematic investment, it involves allocating capital based on data-driven recommendations, free of human, subjective decision-making. In the case of SignalRank, the selection engine makes recommendations matched with pro-rata owning Series A and seed shareholders in the recommended companies. Capital is allocated to these investors, supporting their follow-on rights. The model determines the companies, and it executes the investments it recommends.

SignalRank does not negotiate the terms of Series B. It will take the price decided by the new investors and effectively be a passive, data-driven investor.

It's worth reading it if you are interested in startup investments. I do highly recommend it.