The SignalRank Index: two years in

Building the Series B index from zero to 35 investments

The SignalRank Index (the “Index”) is two years old this month.

The Index now consists of 35 companies, all selected by SignalRank’s proprietary algorithm and accessed via the pro rata of our seed partners.

We started investing two years ago in May. Here are some of the key milestones achieved in those two years:

Top decile performance of US VC funds for the 2023 vintage (per Carta data)

35 investments completed to date, making us the 2nd most active Series B investor in the world. Every investment is alongside the highest quality VCs.

Our growing seed network now gives us visibility of over 50% of all live B rounds globally

The full (announced) Index can be found on our website here.

In this post, we analyze the Index to date, summarize our progress and consider our forward-looking goals.

Index analysis

1. Index performance

The Index is still young as our first investment was in May 2023. We have nevertheless already seen strong momentum in the Index, including:

Chainguard raised $356m Series D

Saronic raised $600m Series C

Three other Index companies are slated to announce Series Cs shortly

Our 2023 cohort ranks comfortably in the top decile of 2,079 US funds based on Carta’s data (where top decile is 1.2x TVPI for 2023 vintages), our 2024 cohort is also performing above that threshold.

2. Index composition

This chart (Figure 1) demonstrates our index construction in terms of investment sizing per opportunity. Our goal is for the Index to be equal weighted at scale. Current variance in check size reflects variability in fundraising. With new capital inflows, we expect improved consistency.

Figure 1. SignalRank Index by check size

Source: SignalRank

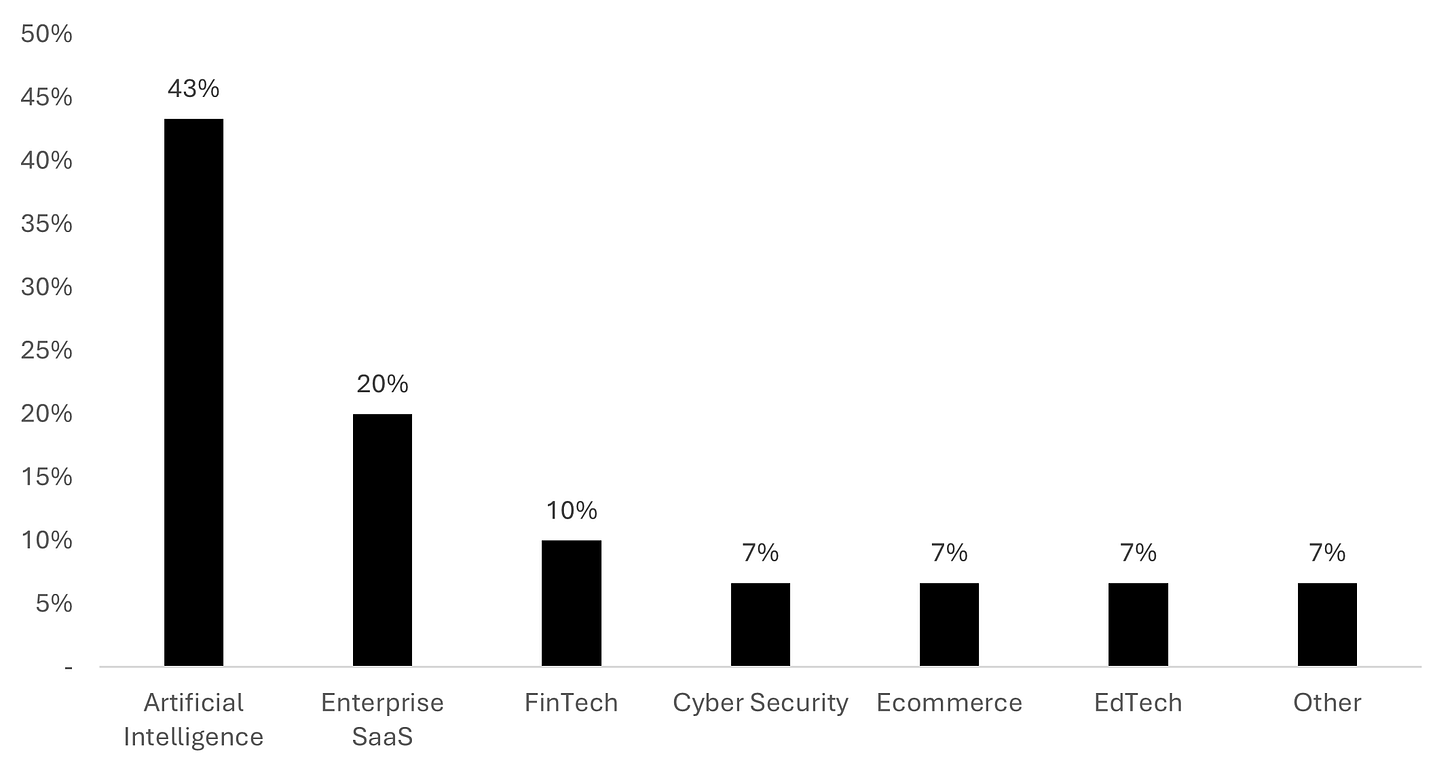

SignalRank’s investment strategy is agnostic to geography, sector and manager. Our Index is majority (67% by number of investments; Figure 2) in the US and the largest sector is artificial intelligence (43%; Figure 3).

Figure 2. SignalRank Index by geography of investment (% of investments)

Source: SignalRank

Figure 3. SignalRank Index by sector (% of investments)

Source: SignalRank; Crunchbase sector designation

Within AI, SignalRank is spotting and funding the next breakout companies (Figure 4).

Figure 4. Select AI companies in the SignalRank Index

3. Sourcing

We have reviewed over 900 pro rata opportunities from 200+ seed managers in the last two years. The 35 Series B investments to date are in support of 27 unique seed managers.

We shared on a previous post how SignalRank is currently experiencing a significant uptick in upcoming high quality Series Bs. The number of post A / pre B opportunities reviewed by SignalRank now exceeds 100+ per month (Figure 5).

Figure 5. Live post A / pre B opportunities reviewed by SignalRank per month since January 2023

Source: SignalRank

4. Access to quality

A major benefit of a quantitative strategy is that you can backtest your model and rank opportunities in real-time to benchmark the success of your strategy. The table below (Figure 6) shows how we invested in two of the top 10 ranked qualifying Series Bs in 2024.

Figure 6. SignalRank’s access to top 10 ranked qualifying Series Bs in 2023 & 2024

Source: SignalRank

In 2025 to date, we have invested in two of the top 10 ranked Series Bs, including the #1 ranked company on our model for this year so far (Together AI). We are seeing our access continue to improve (Figure 7).

Figure 7. SignalRank’s access to top 10 ranked qualifying Series Bs in 2025 (Jan-Mar 2025)

Source: SignalRank

5. Co-investors

SignalRank exclusively invests with the top Series B investors in the world. Our most frequent co-investors (where we have invested 3+ times already) are A16Z, Sequoia, Lightspeed, YC, Khosla, General Catalyst & Founders Fund (Figure 8).

Figure 8. Top co-investors in SignalRank Index (3+ co-investments)

Source: SignalRank; Crunchbase

Since SignalRank started to invest in May 2023, SignalRank is now the #2 most active Series B investor globally in high quality Series Bs (“qualifying” Series Bs per our algorithms; Figure 9).

Figure 9. Top 10 most active investors in qualifying Series Bs since May 2023

Source: SignalRank; Crunchbase

SignalRank is also the #2 most active Series B investor for all Series Bs since May 2023 (including both qualifying and non-qualifying Series Bs; Figure 10).

Figure 10. Top 10 most active investors in all Series Bs since May 2023

Source: SignalRank; Crunchbase

What have we learnt so far?

Some key learnings from our program to date:

Pro rata is a problem for almost all seed managers: we estimate that <1% of seed managers have an opportunity fund, and LPs are increasingly expecting managers to stick to their swim lane (see CRV returning $275m from their growth fund). We have been approached by some of the biggest early stage brands in the industry to explore establishing programmatic pro rata side car funds for their own pro rata. Everyone has a pro rata problem.

Access is a function of check size: we believe that our Index to date demonstrates that our approach of systematic selection, plus attractive seed partner economics (20% carry) and rapid funding (within a week), improves access and can reduce adverse selection. Larger checks will improve our access further.

AI has not changed capital formation patterns so far: AI is enabling teams to build product much more efficiently. But the Greylock thesis that product can be developed with AI but GTM strategies require capital is so far being validated. Some of our Index companies (e.g. Mercor, Together AI) have achieved incredible scale in a short period of time. But they are also raising capital in a fairly traditional manner.

Consistent index sizing requires fundraising clarity: macro market events (e.g. SVB bankruptcy) negatively impacted our fundraising which had an unexpected knock-on effect on Index sizing.

Geography is important: we like the idea that the world is becoming flatter. But location continues to be important. The US remains the key geography for capital, talent and liquidity. SF (and SF proper alone, not even Silicon Valley) is ground zero for AI.

Retail is coming: the market is moving in our direction in terms of indexing private markets (see our earlier post on how to index VC), the democratization of access to VC (see Larry Fink’s recent Chairman letter for BlackRock), and listing of GPs (see General Catalyst’s rumored IPO explorations). The introduction of retail investors to VC is going to be disruptive to allocation models as fund sizes expand.

A VC model that scales: we have a lean team of four full-time employees. Our set up already enables us to operating at the target scale of 30 investments per year. We do not anticipate ever requiring a team that is larger than 10-15 people.

What are our goals for the rest of 2025?

It is an exciting moment at SignalRank. We are at an inflection point across each of our core verticals:

Fundraising: Expand investor base, focusing on family offices and wealth managers.

Deployment: On pace for 20+ investments in 2025 with 12 already closed and over 300 opportunities reviewed.

Model Enhancement: Continue to refine our data-driven selection process.

SignalRank aims to become the premier private market index that provides investors access to high quality VC investments in a low cost, scalable & liquid structure.

Onwards…