How to index venture capital

"Don’t look for the needle in the haystack. Just buy the haystack" - John Bogle

This is not investment advice and is for informational purposes only. Investors should conduct their own research.

It is often said that the private markets are an access class, not an asset class. The power law dynamics ensure that venture is the most “clubby” of all the private markets. You’re either an early stage investor in Databricks / Uber / Rippling or you’re not. The top decile of VCs deliver IRRs of 35%+ (see Figure 1). But most do not. And you can’t eat IRR. 50% of VCs deliver DPI of <1.0x.

So as more investors (including retail investors) adopt the Yale model of allocating 25%+ to alternatives, is it possible to not just “democratize venture” but democratize access to power law returns?

Figure 1. IRR dispersion across all major private asset classes (2004-16)

At SignalRank, we believe that an indexing strategy can deliver the holy grail of making venture capital a scaled asset class that delivers both consistent growth & liquidity. We previously wrote about why indexing of venture is gathering pace. This is clearly the direction of travel. BlackRock’s Larry Fink agrees, commenting after their recent acquisition of Preqin, that BlackRock “anticipates indexes and data will be important future drivers of the democratization of all alternatives.”

OK, but how do you actually index venture capital?

What is an index fund?

First of all, let’s start with shared understanding of what an index is.

We are going to use the working definition from John Bogle, founder of Vanguard:

“The index fund is a practical, cost-effective way to achieve the market’s rate of return with little work and price. Individual stocks, market sectors, and management selection are all removed from index funds, leaving simply stock market risk.”

In practice, index funds have the following broad characteristics:

Broad basket of assets to represent the asset class – indices aim to reflect the underlying asset class by representing the asset price of a diverse number of assets. So, for example, the S&P 500 is made up of the top 500 US listed companies by market capitalization.

Transparent rules-based methodology with predefined weighting - indices aim to minimize manager bias by enshrining transparency with regards to asset selection and portfolio construction. Many indices are equally weighted across all assets.

Passively managed (with some rebalancing) – index managers allow the rules-based methodology to define portfolio construction as the underlying thesis is that the market will outperform individual manager selection. Many indices rebalance (i.e. buy/sell assets) at predetermined times to ensure that the index remains representative.

Updated with real-time data – most indices are live entities where real-time data will lead to the portfolio being updated on a regular basis. This ensures that the index remains up to date with current data.

You could seek to diversify by investing in a fund of funds model, but indices tend to be a superior product for the following reasons:

Indices are lower cost as they are passively managed. Indices also tend to invest direct into companies, eliminating a layer of fees/carry by not investing into funds.

Indices are transparent with rules-based methodologies (thereby reducing manager risk).

Many indices are publicly-traded thereby allowing for liquidity (even if the underlying assets are private).

Index funds have been very successful. The first passive index fund was launched by Wells Fargo in July 1971 with $6m from the Samsonite pension fund. By 2020, indices represent over 37% of the US stock market capitalization.

In 2024, total assets in US passive strategies in public markets surpassed those in active ones for the first time (Figure 2). We anticipate passive investing will accelerate in private markets to echo its growth in public markets.

Figure 2. Historical fund assets: active vs passive AUM

The core thesis behind indexing is that no individual manager can continue to outperform the market in the long term. The data backs this up. S&P Global’s data to compare active & passive managers is absolutely brutal: "among top-quartile active funds as of December 2019, not a single fund remained in the top quartile over the next four years".

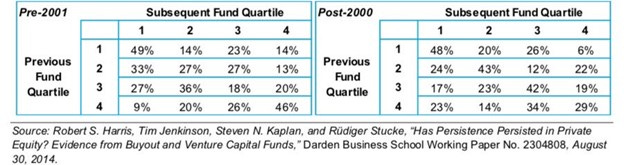

This lack of persistence is seen in both public markets and private equity. In venture capital, however, data demonstrates that persistence is evident. The best returns continue to come from the best investors over the long term.

Figure 3. Persistence for Venture Capital Funds

The challenge therefore is access. Indeed, the power law works at every level in venture: the best LPs access the best VC funds which access the best startups. How can new investors access the top decile returns when the best VC investors are many times oversubscribed and when the minimum check can be $25m+?

How to index VC

The best known public indices are those where selection is by market cap (e.g. S&P 500). We believe that a similar approach of dividing the venture capital market by size / stage is probably the easiest place to start. And, to set expectations, the indexing of the VC market is in its infancy. Today is Day 1.

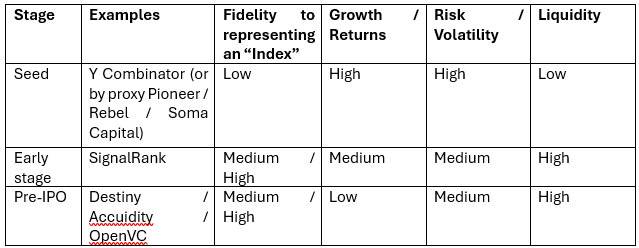

Venture capital can be divided into three sub asset classes by stage: seed, early stage and growth/pre-IPO. These sub-asset classes have very distinct risk/return & liquidity profiles. We see groups seeking to index the venture market at each stage with differing levels of fidelity to the above definition of an index because of the differences is risk/return & liquidity at each stage (Figure 4).

Figure 4. Examples of VC indexing strategies

We will now review each of these strategies in turn and introduce some of the players in this nascent VC index space:

Seed

At the seed stage, there were almost 7,000 seed rounds completed in 2023. The sheer number of investments, the dispersion in returns, and the distance to liquidity makes this part of the market the most challenging to index.

The closest approximation to investing in an index of the highest potential seed companies is probably Y Combinator. On SignalRank’s ranking methodology, we consistently see Y Combinator ranked as one of the top three seed investors globally. At the seed stage alone (ignoring pre-seed), they are investing in 200+ seed rounds per annum (and averaging a $1bn+ pick from seed every year).

Y Combinator has a phenomenal track record, with investments in Airbnb, Coinbase, Doordash, Dropbox, Gitlab, Instacart, Reddit, Rippling, and Stripe to name but a few.

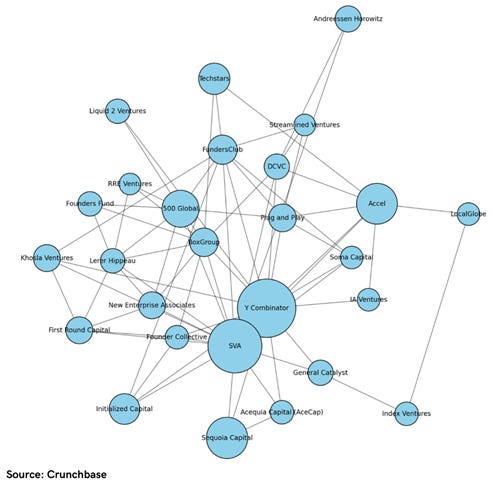

Figure 5 demonstrates the network centrality of seed investors who invest in $1bn+ valued companies (filtered by investors who share 2+ co-investments from their 2019-24 seed investments into $1bn+ companies, with node size showing the number of $1bn+ investments at seed since 2019). Y Combinator is at the center of this ecosystem, thereby representing a form of beta for high quality seed VC.

Figure 5. Seed investor network centrality in $1bn+ valued companies (2019-24)

Yet access to Y Combinator itself is problematic, as they themselves are many times oversubscribed. There are, however, a number of funds which have a high affinity to investing alongside Y Combinator, especially Pioneer Fund, Soma Capital & Rebel Fund, where access is probably easier than investing directly into Y Combinator.

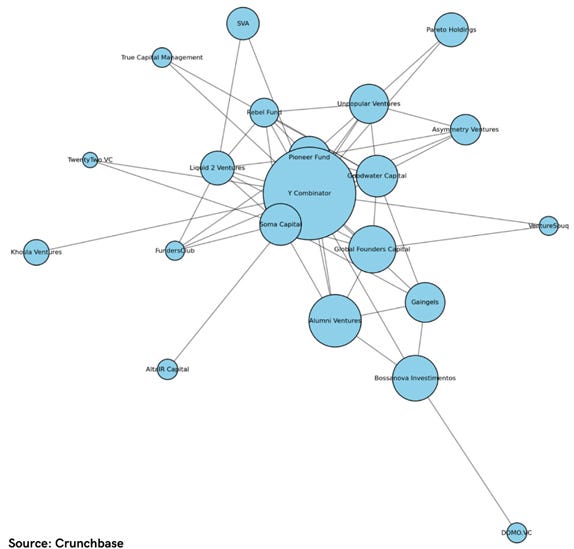

Figure 6 demonstrates how seed investors co-invest with Y Combinator at seed (filtered by investors who share 25+ seed co-investments 2019-24, with node size showing # of seed investments.)

Figure 6. Y Combinator network centrality

Investing into YC (or by proxy Soma Capital / Pioneer Fund / Rebel Fund) will provide decent exposure to top seed companies at scale. Yet the fidelity to the dream of indexing is low, as these are all active managers without fully transparent investment methodologies and with limited liquidity options. Investors here must invest in traditional fund structures with likely holding periods of 10+ years.

Early stage

At SignalRank, we believe that the early stage (where we exclusively invest at Series B) is probably the earliest stage at which a “true” index strategy can be deployed in venture capital because 1) there is sufficient data to allow for a risk-adjusted transparent quantitative approach, 2) access at scale to the best assets is achievable via pro rata (where we have developed a network of 200+ seed partners whose pro rata we finance in qualifying Series Bs selected by our algorithms) and 3) liquidity is easier as holding periods are shorter (and can be more readily manufactured via secondaries).

Even more importantly, the early stage still sees power law returns, allowing investors to reach for the 35%+ IRR. It is possible for individual assets to achieve 100x+ from Series B. With our transparent rules-based methodology, we can increase the probability of investing in a company that achieves 5.0x+ from Series B to c.30% (compared to 10% on average for all active Series B investors). We believe that the potential to deliver top decile venture like returns is a critical component of indexing the venture market.

SignalRank is today a private company. But our intention is to achieve a direct listing in the next 12-24 months once we have reached sufficient scale. A public listing will enable our investors to access their own liquidity with much more ease than most VC investors.

Where SignalRank currently differs from index funds is our fee load. At present, our fee load is more akin to a traditional fund (with operating costs set by our board and capped at 2% of AUM per annum, plus performance fees). However, our model is very scalable with limited additional headcount required; our expectation is that our operating costs will be substantially below 2% per annum at scale (and with performance fees baked in at/prior to the listing). A justification for this fee load relative to an index fund is that we continue to invest in the development & refinement of our models. In this way, we are perhaps more akin to an “alpha capture system” (like Marshall Wace’s TOPS program) than a true index fund.

Later stage / pre-IPO

The later stage market is the most developed segment of the VC index market with numerous players competing with slightly different strategies (including Destiny XYZ, Stack Capital, Private Shares Fund, Stableton & Accuidity).

As these indices are focused on better known late stage assets (e.g. Space X), they have found success in launching public investment vehicles for their private market strategies (e.g. Destiny XYZ listed in 2024 and currently trades at 2x+ NAV). Public retail investors are keen to invest in vehicles which provide access to famed names such as Space X / Stripe / OpenAI.

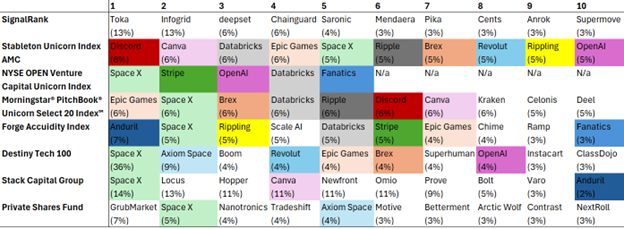

Figure 8 demonstrates how these indices share many of the same names. Space X in particular is a constant overlapping asset. As a result, we anticipate that these different indices will eventually compete on fee load (to the benefit of investors). Destiny currently charges 4.98% (including a 2.5% management fee). By contrast, Vanguard’s S&P 500 ETF costs 0.03%.

Figure 8. Top 10 holdings by index (with shared names color-coded)

Structural access remains problematic for many of these indices. SignalRank only buys preferred Series B stock which we can access by financing the pro rata of existing seed investors. We are directly on the cap tables of our portfolio companies. This is different to many of the late stage indices where access points are varied with differing layers of risk: some indices are investing via SPVs (with additional fees/carry), some are investing via forward contracts, some are investing in secondary common stock (by buying employee shares), and some are participating in preferred stock. From the outside, it is not easy to discern exactly what instrument investors are purchasing in each index.

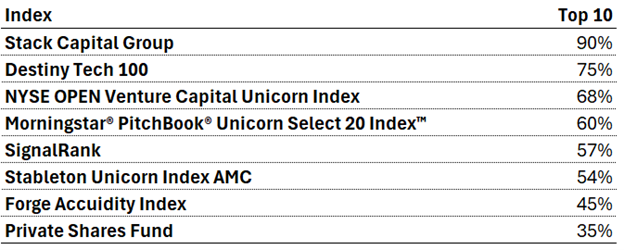

With access somewhat constrained, these indices tend to be more concentrated than their public-market equivalents. This may also be a feature of many of these indices being early in their development (e.g Destiny owns <40 positions and is targeting an ultimate index of 100 positions).

Figure 9. % of index represented by top 10 positions

However, the core challenge faced by late stage indices is that their returns are unlikely to reflect the top decile “venture capital” asset class. Pre-IPO investing does not equate to venture capital. This is for two different reasons:

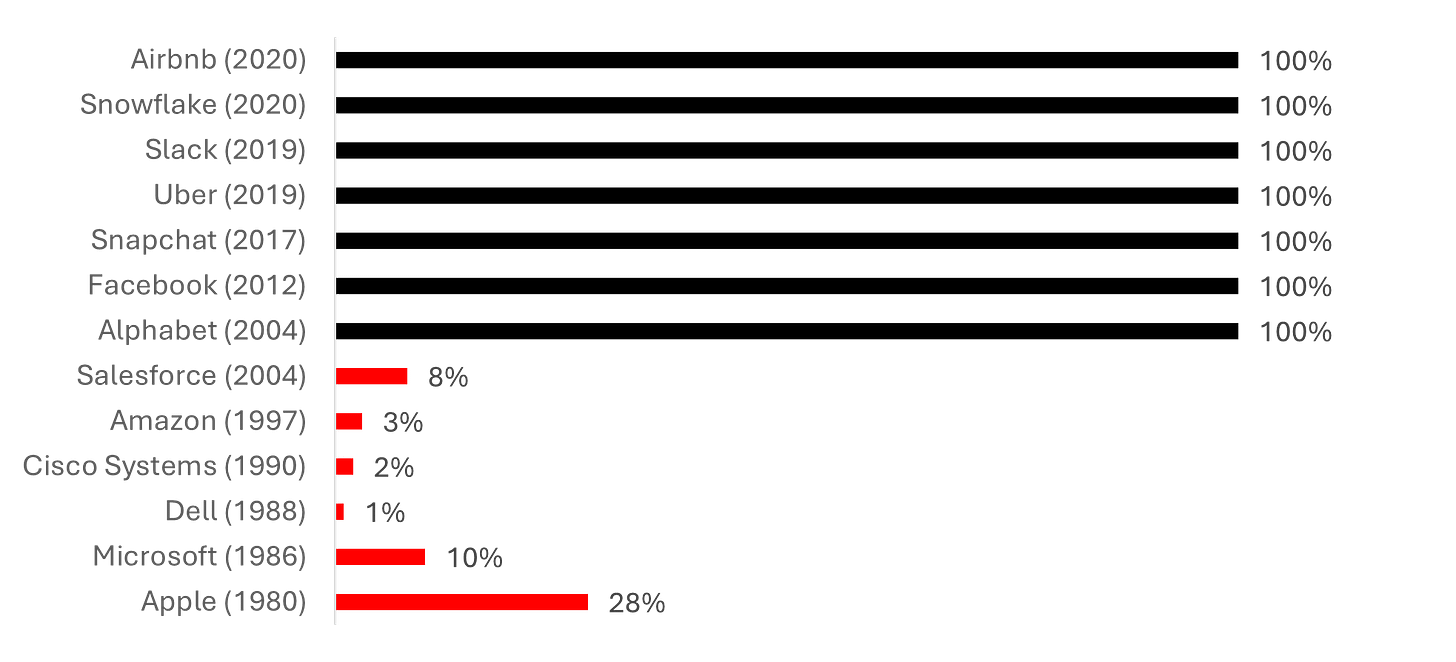

1) Most value in VC accrues at the early stage. Companies are going public later, so are raising increasing number of rounds prior to listing. Figure 10 demonstrates what % of the first $20bn of value is captured prior to an IPO.

Figure 10. % of first $20bn of value captured prior to an IPO

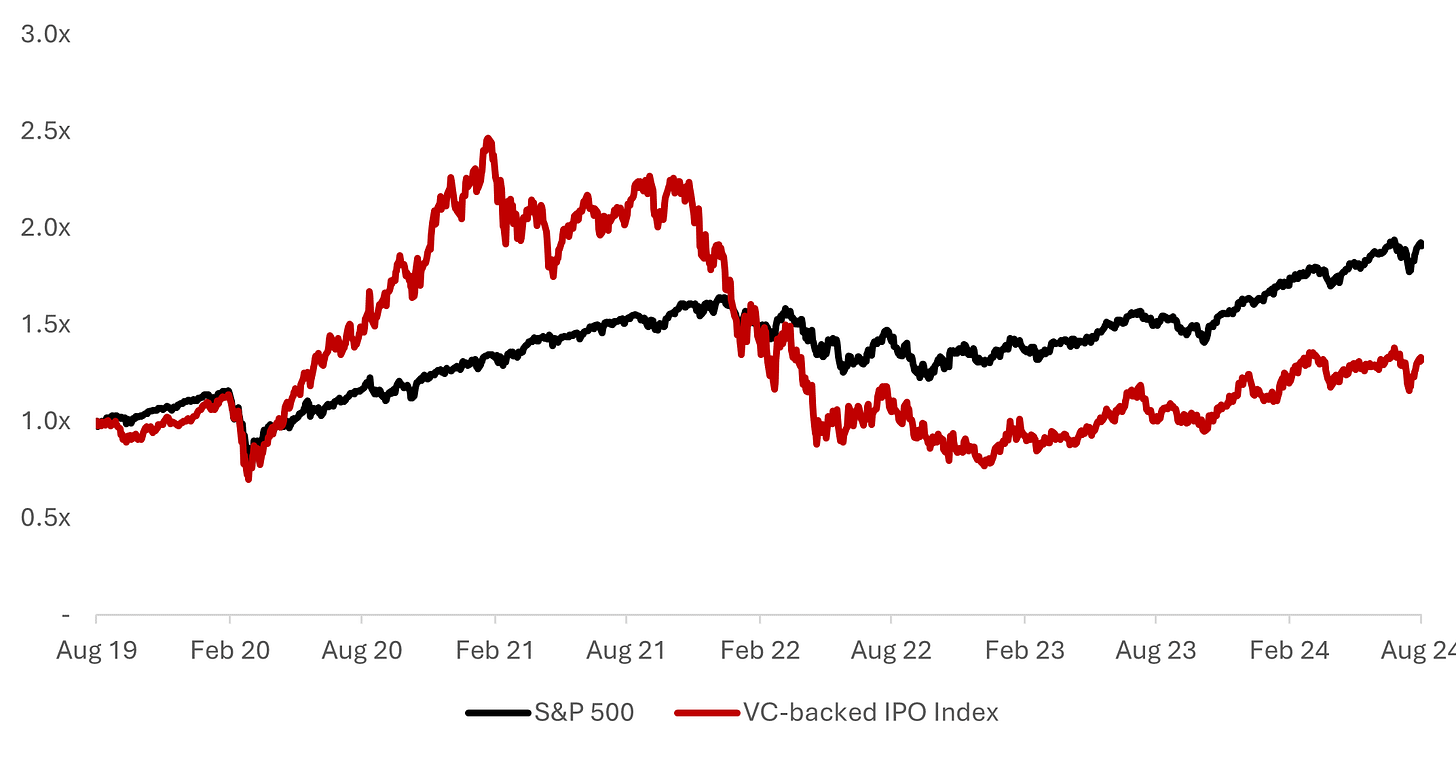

2) Pre-IPO investing has significant post-IPO risk. Many pre-IPO investors have lock-ups post an IPO. Early stage investors may have similar restrictions but tend to already be sitting on a significant MOIC prior to the IPO. This means that pre-IPO investors are much more sensitive to post IPO performance, which, as Figure 11 shows, has underperformed the S&P 500 for VC-backed companies.

Instacart’s IPO is a good example of when both of these late stage problems combine. High capital intensity across multiple rounds & poor post IPO performance has destroyed significant amounts of capital for Instacart investors. The last private investors to make risk-adjusted returns above the S&P 500 returns in Instacart were Series B investors.

Figure 11. Post IPO performance for VC-backed companies

Some concluding thoughts

The siren song of VCs promising 35%+ IRR is strong. We understand why more and more investors seek to allocate to venture. Yet the dispersion of returns among VCs means median venture returns are poor. An indexing strategy should allow investors to approximate for mean returns by accessing some of the best investments at scale. In John Bogle’s words, “don’t look for the needle in the haystack. Just buy the haystack.”

Indexing the venture market is in its infancy with an increasing number of managers seeking to realize this dream at different stages of the market. With BlackRock acquiring Preqin specifically to “index the private markets”, we anticipate more players to enter this space with ever more exotic and competitive products.

Very interesting (as much as I could follow).

The idea's been around for ages. Fully a quarter of a century ago, I briefly worked at Round1 Networks (Jamie Cohan was founder and CEO). They were creating a "Nasdaq for the private equity marketplace." I don't remember how they intended to index all that, but the idea of needle in a haystack goes back at least that long ago. Way back in 1999, I thought this was a very clever idea.