AI Series Bs are here

SignalRank is experiencing a significant uptick in upcoming high quality Series Bs. Since January 1, we have seen 100+ unique live or upcoming Series B opportunities from our network of 200+ seed partners. If each of these companies were to raise a successful Series B in the month we saw the opportunity, this would equate to more than 50% of all Series Bs globally raised per month at current rates.

Figure 1. Live post A / pre B opportunities reviewed by SignalRank per month since January 2023

Source: SignalRank

We have already closed four Series Bs in 2025, with another six expected to close in the next couple of months, in companies backed by the best investors in the world (including three A16Z portfolio companies, two Benchmark portfolio companies and two Sequoia portfolio companies). This is tracking at a faster pace than our target of 20 investments this year, and faster even than our long term target of 30 investments per year.

Why is this happening?

The AI boom has arrived in Series B land. Companies which formed after the initial ChatGPT moment in late 2022 are now starting to raise Series Bs.

There are three possible explanations for why SignalRank is seeing more Series B opportunities in 2025: 1) we have a larger network of seed partners today, 2) the quality of seed partners is higher today with a higher volume of quality opportunities and/or 3) market activity is accelerating. While 1) & 2) are certainly true, we believe the uptick in flow is due to AI market activity. It turns out that AI is all you need to reinvigorate the Series B market.

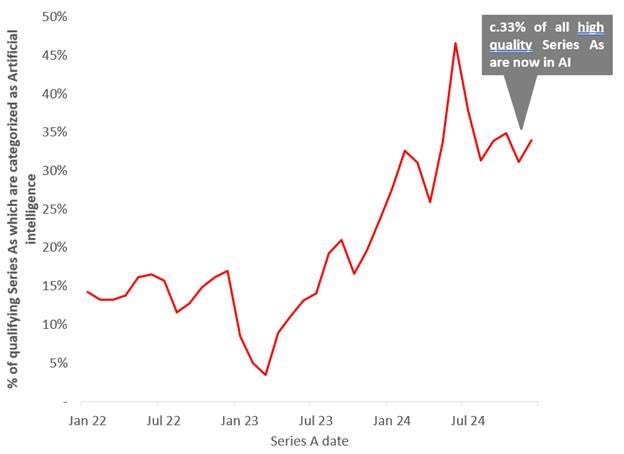

We previously noted in our annual state of the Series B ecosystem report how almost a third of candidates (post Series A / pre Series B companies which we believe have signal; roughly top 10% of Series As) for our product are in AI (see Figure 2). The fastest growing of these Series A companies are now raising their Series Bs, and often within six months from their Series A.

Figure 2. Percentage of qualifying Series As (candidates) per month in AI

Source: Crunchbase

Of the 100+ upcoming Series Bs reviewed by SignalRank this year, 31% are in AI (using Crunchbase’s sector designation as the definition; this almost certainly understates the actual percentage).

SignalRank’s dataset is clearly a sample, not the overall market. But it is worth noting the following about the AI Series B opportunities seen by SignalRank this year:

50% are in the Bay Area (36% in SF itself). SignalRank has a global remit and we do see opportunities across the world. This data reflects how SF is the epicenter for AI startups.

48% raised their Series A in 2024 and are already raising a Series B. The fastest growing companies are raising Series Bs shortly after their Series As.

Average of $7m seed round, followed by $23m Series A. AI companies are attracting more capital at each stage than their non-AI peers.

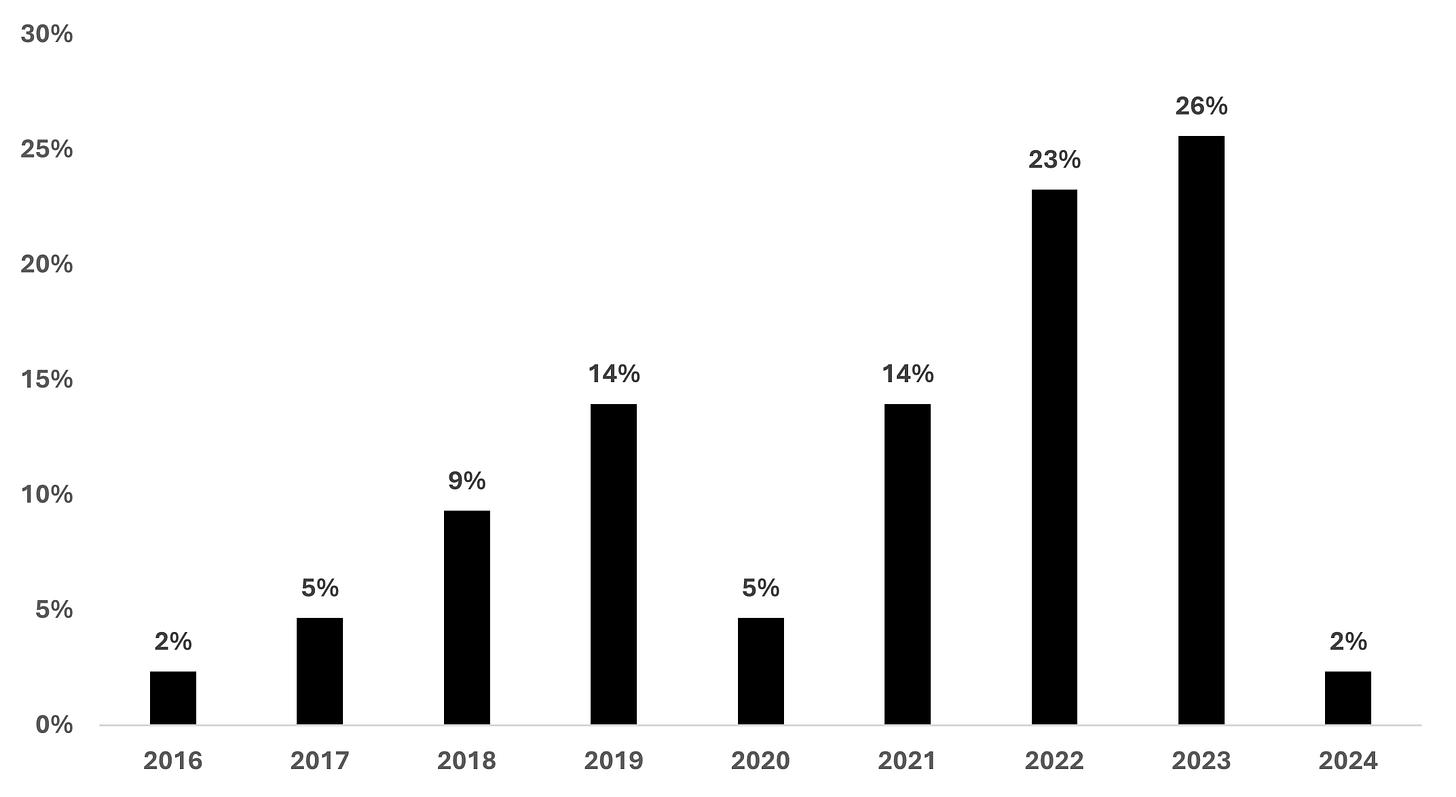

Over 50% of these AI companies raising a Series B were founded after the launch of ChatGPT (Figure 3).

Figure 3. Company founding year (2025 AI Series B opportunities reviewed by SignalRank)

Source: SignalRank

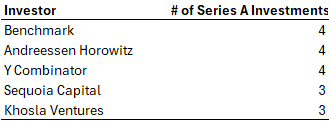

These are high quality opportunities backed by the best investors in the world. The top existing investors in these companies are Benchmark, A16Z and Y Combinator (Figure 4).

Figure 4. Top 5 Series A investors in 2025 AI opportunities reviewed by SignalRank

Source: SignalRank

How does SignalRank’s data compare to the overall market?

According to Crunchbase, there have been 233 Series Bs announced as completed in 2025 so far, of which 36 are in Artificial Intelligence (15%) by their sector designation. Of these AI Series Bs, 28% are in companies in the Bay Area.

The mean Series B in 2025 so far has been $39m. The mean Series B for AI companies in 2025 has been $57m, which is 65% higher than the mean Series B for non-AI companies in 2025 of $35m.

SignalRank is seeing a higher percentage of AI companies: 31% of all Series B opportunities seen by SignalRank are AI companies, compared to 15% for the overall market.

(One caveat is that this is not strict apples to apples, as SignalRank’s data is live / not completed rounds, whereas Crunchbase’s data is completed rounds; this difference in AI companies raising Series Bs could reflect a lag in completion / reporting in the Crunchbase data set.)

Is an AI bubble emerging at Series B?

The overall number of all Series Bs (including non-AI companies) remains subdued relative to historic vintages. The total number of Series Bs in 2024 fell by 6% compared to 2023 to 1,144 (in-line with 2014 levels of activity). Non-AI funding rounds remain slow. But the average round size is the highest of any vintage, as AI today is a capital intensive technology.

It is worth noting that SignalRank has a model which is dynamic to the market, such that the threshold for qualifying for our product changes with live conditions. In this way, when the market heats up, it becomes harder to unlock capital from SignalRank. This means that we are not overly concerned about pacing of deployment for SignalRank’s capital; it does mean that we have had to reduce our average check size to keep up with the number of qualifying opportunities available.

While last year saw some large capex intensive foundational model AI Series Bs (think Mistral & xAI), we are in 2025 seeing a number of vertical AI companies at the application layer scale to $100m+ in ARR within two years of formation. The old “triple triple double double double” formula to building a $1bn+ company looks archaic by comparison.

There are legitimate questions about the quality of this revenue and whether this hyperscaling does indeed demonstrate product/market fit. The first concern is whether the current level of AI budgets within enterprises will sustain. Boards are requiring management teams to formulate & fund an AI strategy. This has led to larger (and possibly artificially large) AI budgets – if no revenue / cost savings result from AI in the short term, will these budgets sustain? McKinsey argues here that most companies are not (yet) getting the returns they had hoped for from AI pilots; ~50% of C-suite respondents argued their AI budgets were at experimental pilot stage. The second concern is that scaling to $100m ARR in <2 years implies that there is a limited moat. How sticky is this revenue? Why couldn’t a competitor replicate this rapid scale?

VC fundraising has become concentrated in the top managers. The top 30 VC brands raised 75% of all capital last year (according to Pitchbook). Larger fund sizes enable these multi-stage managers to write larger checks into ever more companies per vintage. A16Z invested into 29 Series Bs last year - they are on pace to exceed this number in 2025. Given the larger fund sizes, the market size potential of AI and higher rates of company formation of AI startups, heightened activity from these VC brands is entirely rational.

Pricing of high quality Series Bs is high. Revenue multiples are in the 10-40x range (in companies which are targeting 4-5x annual growth in revenue). Public & private AI companies are trading at a premium to non-AI peers, but this premium can currently be rationalized by the higher growth & future growth potential of AI companies.

In short, it does not feel like we are quite back to the 2021 levels of Series B market mania. Not yet.