VCs are intermediaries between capital and founders. USV’s Fred Wilson summarized the role perfectly in 2017:

"VCs are a service provider to entrepreneurs. We ride on their coattails. And so even though venture capital requires a sophisticated understanding of finance, technology, markets, strategy, it's ultimately a people business. Learning to be a successful venture capitalist is about learning how to work with people. A particular breed of people who are at the same time charismatic, brilliant, frustrating, anxious, and fragile. And our job is to meet them right there where they are, and support them with all our might."

No notes.

Viewed through this lens, the comparison between musicians and VCs is deeply offensive to musicians. Musicians are artists and creators. VCs are not. That would be the founders.

And yet, there are some parallels between the industries which are worth drawing attention to. In particular, both music & VC are strong power law industries, where brand is a critical component to driving the spoils of success to a small number of participants.

The relative importance of brand is much higher in venture capital than in most other financial asset classes. To deliver power law returns, VCs need the best founders to pick them, which requires brand building; per A16Z’s Marc Andreessen, the errors of omission are worse than the errors of commission.

In this post, we are going to focus on the impact of social media on brand, leading to a steepening in power law dynamics. The algorithms clearly favor content focused on individual personalities, not groups. This has already been felt in music and is starting to be felt in the venture industry.

Concretely, this is an argument that the future of alpha generation in the venture capital industry is likely to be solo GPs. Across industries, brand development in the era of social media is much more effective by focusing on authentic personality than staid corporate truisms.

Taylor Swift has been the iconic beneficiary of these trends in music. She is an enduring solo artist, with captive mindshare and a distinctive musical style. Who is emulating this in venture?

Content is king but distribution is King Kong

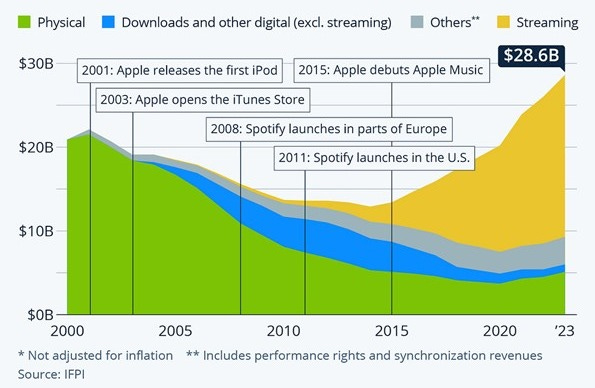

The media industry tends to be impacted by technology changes first, due to light regulation and lower barriers to entry. The music industry was walloped by the introduction of digital content but has subsequently reinvented itself with streaming and a focus around a small cadre of individual creators (Figure 1).

Figure 1. Global recorded music revenue ($bn)

The concurrent development of social media & streaming has accelerated a shift towards solo artists and steepened the power law in favor of a much smaller number of creators.

Justin Bieber was arguably the first social media music star, discovered in 2007 when Scooter Braun viewed Bieber’s YouTube videos by accident. Bieber demonstrates the democratization of distribution, how artists can build an enormous global audience and create a fanbase community to build momentum before getting on the radar of labels.

Yet it is Taylor Swift who dominates the new music industry, truly harnessing shifting technology trends to her advantage. It is hard to overstate the dominance of Taylor Swift in the music industry. In October 2022, for the first time in history, the entire Billboard Top 10 consisted of songs from a single Taylor Swift album (Midnights). In the US, Google searches are higher for Taylor Swift than for Jesus. Her Eras tour was the highest revenue generating tour of all time with $2bn of ticket sales (and even impacted CPI data in Sweden).

Taylor Swift embodies broader shifts in the music industry, especially the move to solo artists and the concentration of hits in smaller number of artists.

This chart demonstrates how the Billboard top 40 has evolved since the 1970s, with solo artists eclipsing bands (Figure 2). The ease of marketing a single personality on social media is one factor for this development. But so is the shift in popular genres to hip-hop and EDM which tend to favor solo artists (and the decline of rock which requires a band).

Figure 2. % of Billboard top 40 by artist type (1970-2020)

At the same time, the power law of the music industry has intensified, with higher concentration of hits among fewer artists. Again, social media enables artists to form parasocial relationships with their fans to create much stronger ties between artist and fan. But also important is the shift in distribution from physical to digital, with algorithms creating feedback loops for users that promote popular artists.

Figure 3. Number of Billboard top 40 hits by top-selling artists each year

This exacerbation of the power law is not unique to music. This deck on the upheaval of the media industry demonstrates how popularity is an extreme power law across all media forms (Figure 4).

Figure 4. Power laws across various media

The same deck demonstrated how creator media is growing at 26% CAGR globally compared to 3% for corporate media.

Figure 5. Global corporate media vs creator media revenue

What about venture?

LPs have historically backed partnerships of multiple GPs. A VC’s core product is its decision-making engine, where diversity of opinion, complementary skillsets and access to differentiated networks should improve outcomes. Not to mention the ability to diligence more opportunities by adding additional bodies.

Yet the relative importance of an individual’s brand within a partnership has been increasing for a while. Correlation Ventures argued in 2017 that the value of a firm is no more than the sum of its partners. Founders are keen to work with specific individuals (who are ideally ex operators, not Excel jockeys), instead of specific firms. This has happened simultaneously to the professionalization of angel investing. And of course the growth of social media.

Footwork’s Nikhil Basu Trivedi first pointed out the rise of solo capitalists in 2020. The collapse of the industrial unicorn complex since 2022 has acted as a catalyst to this trend. High profile GPs in their 30s and 40s are increasingly electing to spin out on their own rather than spend the next ten years delivering 1.0x DPI for the 2020/21 funds. This is akin to band members going solo in the music industry; although we will see that (in music & VC alike) not every solo artist replicates their success within a band…

Pitchbook wrote a recent article on the growing phenomenon of solos GPs and listed notable recent funds (including Elad Gil who has raised a $1bn solo fund):

Figure 6. Notable recent solo GP funds

In this framing, Chemistry, a new $350m fund from alumni of Bessemer, Index & A16Z, looks more like a throwback to the industry of yore. Multiple GP partnerships are no longer necessarily the default option.

This growth of solo GPs is particularly notable in a period when the power law in venture capital is steepening at every level (echoing the trend described above in music):

Less capital ($76bn raised by US VCs last year is lowest since 2019)…

…is concentrated in fewer GPs (with 30 firms last year raising 75% of all VC capital)…

…which are concentrating investments in fewer companies (Redpoint showing 31% of all capital invested in 20 deals last year on slide 30)…

… where power law exits are even fewer and farther between (slide 35 of the same Redpoint document).

As firms become the individual, so the brand becomes the individual. The flourishing of solo GPs has been supported by social media powering broad content distribution. Harry Stebbings is an obvious beneficiary of this development, with a ten year journey that has seen him successfully parlay a VC podcast into a VC firm with a chunky $400m new fund.

The idea of an individual GP as the brand / “the talent” is in-line with broader media trends. As Elon Musk likes to argue, you are the media now. Authentic and distinct content focused on VC can garner an audience.

Could Taylor Swift be the Taylor Swift of VC?

A short aside on various celebrities seeking to cross pollinate their audience for VC investments (such as Serena Williams, Nas and Leonardo DiCaprio). Ashton Kutcher was most successful at this in the time of cable TV; his promotion of his actual angel investments (including Spotify, Uber & Airbnb) on screen fitted his character in Two & a Half Men.

Yet the currency of authenticity has primacy in the era of social media. Celebrities promoting their VC investments on social media too often comes across as a grift. It’s not perceived as authentic. Taylor Swift is winning in music because her heartfelt songs tap into her audience’s emotions. Harry Stebbings has built an authentic voice focused on venture. The idea of a celebrity as a VC has not yet endured in the social media era.

So who is the Taylor Swift of VC?

The vast majority of LP capital will continue to flow to established multi-GP partnerships. But we should not be surprised to see solo GPs to play an ever increasing role in the VC ecosystem.

Individual VCs have learnt how to master brand building and command audiences on social media. Yet to become the definitive solo VC would require 1) enduring success over a long period of time, 2) saturated mindshare, and 3) a signature style / taste of investing that marks the individual out.

With this criteria, I would argue that no one has achieved Taylor Swift status in venture. Not yet.

Or in Taylor Swift’s words: “I've got a blank space, baby. And I'll write your name”.