Top Series B lead investors

"Only a handful of companies per year actually matter" - VC folklore

DST Global’s Cole Rotman created this sheet to keep track of Series A leads in every $5bn+ venture-backed company (ex crypto, energy, bio & China).

The output from this work is this list (Figure 1) of the top Series A lead investors, ranked by number of lead investments in $5bn+ companies. He shows A16Z as #1, followed by Sequoia, Benchmark & Accel.

Figure 1. Top Series A lead investors in $5bn+ companies

Using the same list of $5bn+ companies as Rotman, this post conducts the same analysis for Series B lead investors, as well as considering earlier investors.

Series B lead analysis

1. Series B lead investors: General Catalyst is the #1 lead investor

Figure 2 ranks Series B leads in $5bn+ companies (where an investor has led 2+ Series Bs in these companies).

With Crunchbase data, the number of lead investments in all Series Bs since 2012 is shown. This column is used to calculate a hit rate when each of these investors leads a Series B ($5bn+ Series B lead / all Series B lead).

General Catalyst is the #1 investor for leading Series B investments into $5bn+ companies. But Benchmark has an astonishing 19% hit rate when they lead any Series B (followed by Y Combinator at 13% and Greenoaks at 11%).

A16Z is the #1 investor in all Series Bs in $5bn+ companies, with 16 investments (including 5 where it led and 11 where it did not lead).

Figure 2. Series B lead investors in $5bn+ companies

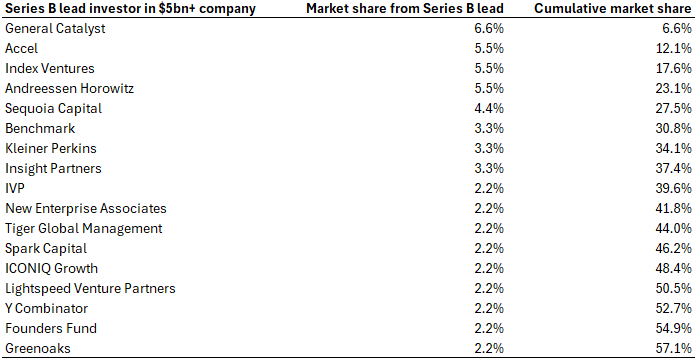

2. Series B market share: no single firm dominates

We then reviewed the market share for each lead in $5bn+ companies, comparable to the analysis that Rotman conducted for Series A (Figure 3).

This demonstrates a fragmented market where no single investor has market power. You would have to be an LP across all top 14 funds to achieve 50%+ market share.

Figure 3. Market share for leading Series Bs in $5bn+ companies

3. Lead investors over time: the best firms have persistence

In Rotman’s analysis, he also considered lead investments over time. Figure 4 shows similar analysis for Series B lead investors.

Figure 4. Lead Series B investments into $5bn+ companies by year

4. Series B hit rate: Benchmark has 11% rate in hitting $5bn+ companies

Finally, we consider an investor’s hit rate for all its Series Bs since 2012 (Figure 5, includes both non-$5bn+ investments and $5bn+ investments, and for both leading and non-leading investments).

Benchmark has a remarkable hit rate, investing in a $5bn+ company 11% of all Series B investments.

Figure 5. All Series B investments since 2012

Who are the earlier investors in these $5bn+ companies?

Pre-seed

Y Combinator is the undisputed champion of pre-seed investing in $5bn+ companies from Rotman’s list, by number of pre-seed investments into these companies. Its six investments at pre-seed include: Brex, DoorDash, Snap, Stripe, Whatnot & OpenAI.

Seed

Y Combinator again dominates seed investing into these companies (Figure 6).

There are 290 unique seed investors in the seed rounds of these $5bn+ companies. It is this large network of investors whose pro rata SignalRank is financing for our own Series B strategy.

Figure 6. Investors with 3+ seed investments into $5bn+ companies

Series A

A16Z is the #1 investor in Series A investments. This list adds to Rotman’s Series A analysis by including both lead & non-lead Series A investments in $5bn+ companies (Figure 7).

There are 228 unique Series A investors in the Series A rounds of these $5bn+ companies.

Figure 7. Investors with 4+ Series A investments into $5bn+ companies

Concluding thoughts

There are no huge surprises here. If anything, this analysis reinforces some core assumptions at SignalRank:

There are power laws at every level of VC. VC outcomes are dominated by a small number of companies, financed by a small number of investors, which are backed by a small number of LPs. The success of Y Combinator at pre seed & seed is extraordinary. Benchmark’s hit rate is very impressive.

Investor brands have persistence over time. The same investors have been backing the winners for the last 10 years (and mostly for the 10 years before that too).

No one individual firm has dominant market share. An LP would need to make an investment into multiple of these winning firms to cover the market. Access & high check size make such a strategy challenging to execute. At SignalRank, we aim to offer an alternative whereby an investor can access greater market share across a diversified portfolio with one single investment into SignalRank itself.

A data-driven approach can identify winners at scale. Our model qualified 61% of these companies at Series B. If SignalRank had been operational at the time of these Series Bs, we would have sought to access these companies via the pro rata of our network of more under-the-radar seed managers.