The trend is not your friend

"Hot" themes compared to value creation; if there's a market map, you're too late

Mark Suster, from Upfront Ventures, encouraged VCs in 2010 to invest in lines, not dots. His main point was that investors want to see multiple data points over time that suggest a trajectory (a line) instead of relying on a single data point (a dot). As such, founders should interact with investors early, enabling investors to measure progress & establish a relationship (Figure 1).

Figure 1. Mark Suster implored investors to invest in lines

This sound advice is being largely ignored. Venture capital is a proper global asset class now. There is greater competition for individual opportunities which requires compressed investment processes. Compound’s Michael Dempsey wrote a lament that investors today are investing in dots, not lines.

A highly connected ecosystem (echo chamber?) encourages this memeification of venture. The market mapping. The creation of socially-approved “spaces”. I would also argue that the punctuation of the calendar around Y Combinator’s now quarterly Demo Day accentuates the idea of investing around themes and exacerbates investor FOMO.

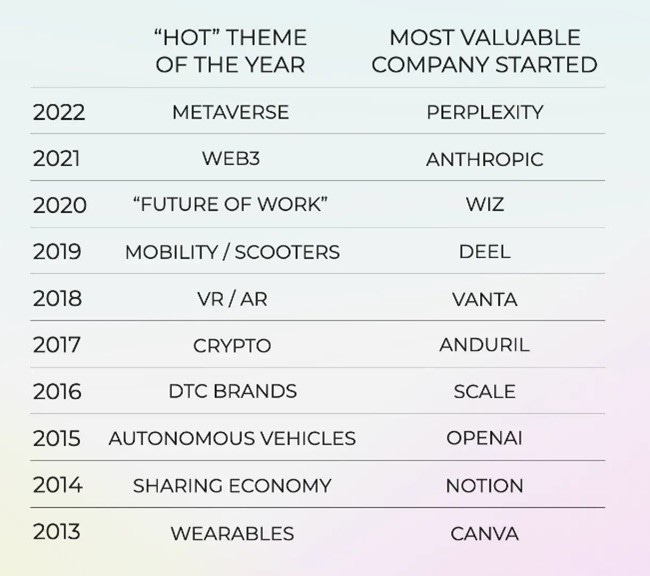

There is a constant ebbing and flowing of “hot” themes which rarely translate into value. Daybreak’s Rex Woodbury recently published this comparison between the theme du jour and the most highly valued company created per year (Figure 2).

Figure 2. Rex Woodbury’s themes vs value

Woodbury is similarly critical of mimetic thinking, especially the ‘____ for X’ model (a la ‘Uber for X’). He cites 31 companies on the YC website that describe themselves as the “Cursor for X”; “every good VC wants to be in the company that comes before the x."

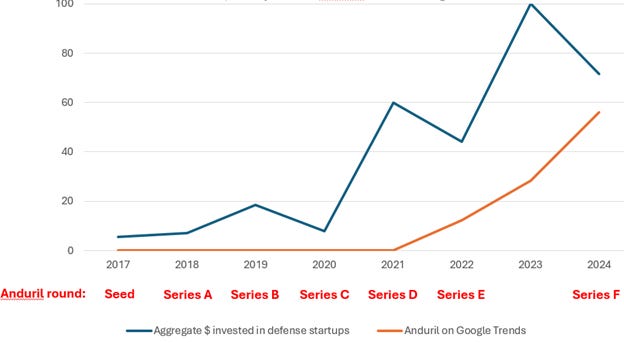

An investor’s job is to find singular founders who can build category-generating companies. The good news is that this is exactly what the best investors are doing, evaluating founders on a standalone basis (not a relative basis within socially approved themes). Founders Fund’s Trae Stephens wrote eloquently here about how VC hype happens “after the winning company in that space has already been created, discovered, funded, and become popular.”

Our data supports Stephens’ post by showing how defense became a "space" only after Anduril raised its Series C and once socially viable (via Google trends; Figure 3).

Figure 3. Aggregate $ raised by defense companies & searches for Anduril (both rescaled), compared to Anduril round timing

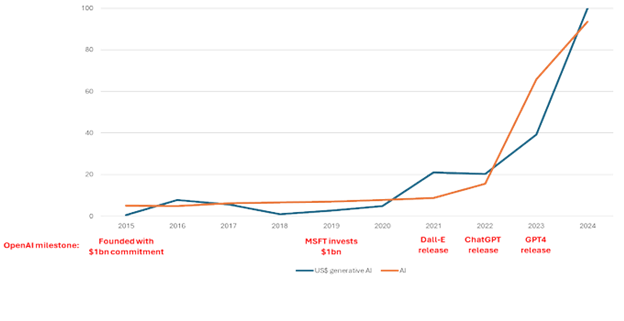

AI sees a similar phenomenon once OpenAI released ChatGPT (7 yrs after founding). VC dollars are highly correlated with social proof (via Google trends; Figure 4).

Figure 4. $ invested in AI & Google trend data on AI (both rebased), compared to key OpenAI milestones

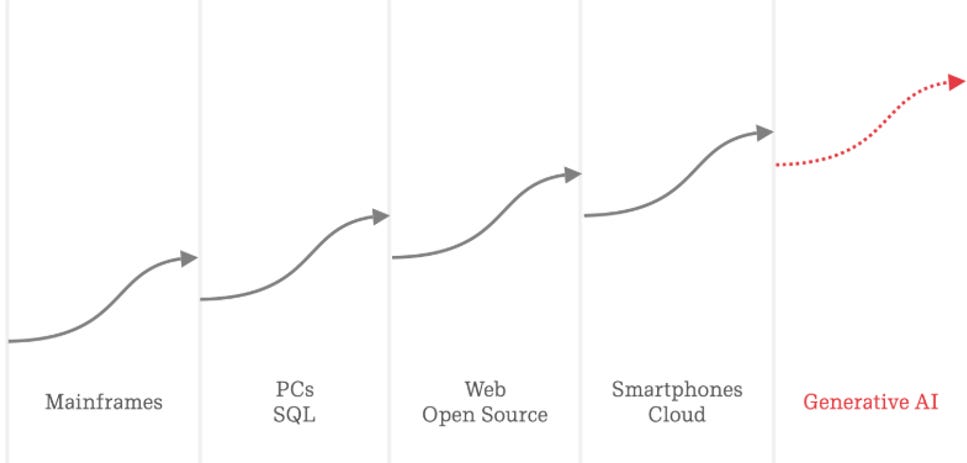

This is also not to argue that the best investors operate in a vacuum. Clearly they do not. Indeed, an investor’s antenna is constantly seeking to identify the next legendary platform shift on which founders can build companies (Figure 5).

Figure 5. Platform shifts from Benedict Evans’ latest presentation

Yet, contrary to popular opinion, the best investors are decent at resisting the hype. They are building networks & relationships (creating lines, not dots) in unusual places. In the words of Equidam’s Dan Gray, they are “confident weirdos.”

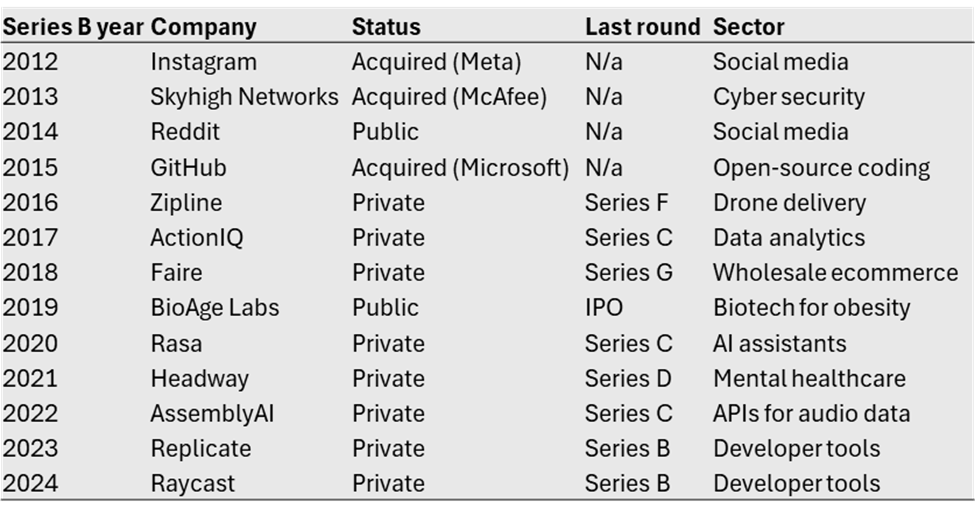

When we look at the highest ranked Series Bs (via our methodology), we see a similar difference to the “hot” themes in Rex’s list (Figure 6). Maybe the best investors know what they're doing?

Figure 6. #1 ranked Series B per SignalRank’s methodology

Floodgate’s Mike Maples put it succinctly by arguing that “discipline and patience are a form of arbitrage. Play your game by seeking inefficient markets while everyone else is regressing to the mean.” Or in Yale’s David Swensen’s words, investors need to have “uncomfortably idiosyncratic portfolios” to generate returns for LPs.