The art & science of reserve strategies

The rise of pro rata funds, alongside core reserves, SPVs & opportunity funds

The first investment is relatively easy. The investment committee loves the founder, the company is in the magic quadrant of the market map, the pitch deck is shiny, the projections look good, the references check out and the risk/return profile is compelling.

It’s the second investment that is more challenging. You know the inside track, including both the challenges & the opportunities for the company. You also know that LPs scrutinize these second checks much more closely because they know that you know the inside track. And, despite your relationship with the founder of a company whose product market fit is always just around the corner, you know the power law dictates that you should only deploy precious reserve capital into companies that can return your fund.

In short, reserve strategies, the practice of holding back capital from your initial investment for subsequent rounds, are not straightforward.

In this post, we are going to explore the considerations around a reserve strategy, dive into data on the signaling impact of reserve strategies, review the opportunity for opportunity funds, and finish with an unabashed pitch for why SignalRank is a solution for this problem. 😊

The pros & cons of having a reserve strategy

The existing canon on this topic is decent. Sapphire’s Laura Thompson wrote what is potentially the definitive guide, including some numerical scenarios to guide GPs. Similarly, USV’s Fred Wilson has written about reserves here.

Received wisdom is largely that GPs should have a reserve policy with capital to support existing portfolio companies beyond the initial check:

Defend ownership to increase upside: Following on enables GPs to defend their ownership in a company, thereby increasing potential upside in the event that the startup generates a power law return. The alternative is to allow dilution across multiple rounds, such that your 10% ownership could be diluted by 30% or higher by the time of an exit.

Signaling: There is a signaling element to insider investors re-upping into subsequent rounds. Given limited capital & VCs’ incentive to focus on power law returns, a second investment signals to external investors that existing investors continue to believe in the company’s vision & its trajectory. This can support a founder’s narrative when pitching to external investors for the next round. It also supports an investor’s standing in the eyes of a founder – the dilution impact for failing to follow on can be felt as much in terms of influence as in economics.

Supports a VC’s pitch to founders: Founders like to have investors who can support companies across multiple rounds, both by reducing capital required from new investors (and time spent fundraising with new investors ) and by signaling continued support. Multi-stage support can be a major selling point for VCs to founders.

At the same time, GPs need to be mindful of their reserve strategy:

Potential to hurt IRR: Later rounds typically require larger checks with lower expected multiples than original checks. This can hurt fund economics. Sapphire’s Laura Thompson shows in her piece (referenced above) the marginal benefit of a reserve strategy, even in a portfolio with a power law winner. Why take the risk?

Absorbs capital: Reserves absorb capital which could instead be used to make more first time checks which have higher multiple potential. Peter Walker, who leads data insights at Carta, had a recent discussion here about how seed funds should prioritize shots on goal over reserves; an elegant reserve strategy is moot in a fund without a power law company.

Increases fundraising time: Larger fund sizes with higher proportions allocated to reserves could increase fundraising time for each fund (especially if the reserve capital is held within a separate opportunity fund vehicle).

Absorbed by down rounds, not stars: In turbulent times, more capital is absorbed by portfolio companies which require bridge rounds or down rounds than was originally modelled. This requires even more dispassionate analysis of the whole portfolio to identify which companies really could benefit from reserve capital (or will just die). Balderton’s Suranga Chandratillake has a nice piece here on this challenge. The best funds consider each subsequent investment into a company on a stand-alone basis (with prior investments as sunk cost).

What does the data say?

We looked at Crunchbase data from various funds who invest in seed stage companies to consider their follow on strategies from seed (for seed investments between 2012 and 2020). We stopped at 2020 as we want to leave sufficient time to see how the seed stage companies have developed since.

Figure 1. Seed follow-on stats for selected funds for 2012-20 seed investments

This table shows the number of seed investments made by the investor over the period. It then looks at what % of these seed investments raised a Series A, and what % of these Series As the seed investor re-upped. By multiplying these two percentages, we see the probability that an investor will re-up from the perspective of all seed investments.

This appears to show the following:

Seed indexers have a very different investment strategy (duh) to the rest of the market at seed. They are making more investments, of which a lower proportion go on to raise a Series A and where the seed indexers are more selective about following on. This could be a signaling issue (as they do not want to signal to companies where they do not invest that one company is preferred over another) or potentially a lack of capital issue.

Seed managers have decent conversion rates to Series A. Companies which raised a Series A have a one in two chance of attracting additional capital from their seed investor. This is probably more driven by capital availability than signaling.

Multi-stage funds and cross over funds can make a compelling case that companies where they invest at seed have a higher probability of the company raising a Series A round. This is not to argue for causation but there is a correlation. These funds also more often than not tend to participate in the Series As.

Series A conversion is one thing, but what percentage of these seed investments became power law companies? The following table considers this by looking at unicorn conversion. Obviously this is a vanity metric and the ZIRP unicorns are largely not real but remember: all power law companies are unicorns, but not all unicorns are power law companies. So it is worth studying unicorn conversion. Ideally we would also consider exit data, but there have been insufficient exits (especially from the later part of this cohort) to make concrete conclusions.

Figure 2. Unicorn conversion for select funds from seed investments which successfully raised a Series A (2012-20 seed investments)

This data looks at all companies which raised a Series A where the investor was a seed investor between 2012-20. The idea is to consider how effective the investors is at following its seed investments at Series A.

The key metric used to establish this point is unicorn efficiency which is defined as the number of unicorns ($1bn+ valuations) where the investor was a seed investor (and the company raised a Series A) divided by all seed investments 2012-20 by the investor (where the company successfully raised a Series A).

The next column looks at the difference in the number of unicorns between when the investor only invested in the seed (not the A) versus when the investor also invested in the Series A.

What can we conclude?

A top investor investing in the seed & Series A is neutral to positive as a stand alone signal in terms of efficiency (versus a top investor only investing in the seed). A top investor following on is positive as a signal in terms of the number of unicorns. There are on average 2.6x more unicorns in a dataset when one of the top multi-stage funds has invested in both the seed & Series A compared to where they just invested in the seed alone.

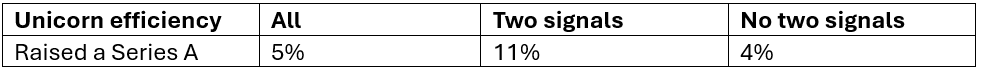

The data above is for select funds. The table below (Figure 3) shows similar analysis for the global market for seed investments between 2012-20 for companies which went on to raise a Series A. A company with “two signals” is where a top 200 ranked seed investor invested in both the seed & Series A. The probability of a “two signal” Series A stage company becoming a unicorn was 11% (compared to 4% if a seed investor has NOT invested twice).

Figure 3. Unicorn efficiency for all post Series A companies which raised a seed round between 2012 and 2020

With SignalRank’s model, we also take into account the other participants in each round, as well as the quality of the Series B round. By investing one round later at the Series B (which eliminates a number of Series A companies which do not raise a Series B at all, or raise a low quality Series B), we can increase the probability of investing into a unicorn at Series B to above 30%. This is a 3x higher hit rate than the market average at Series B.

What about opportunity funds?

GPs have three established ways in which they can continue to finance their portfolio companies beyond the initial check.

Reserve capital within core fund. Reserve capital, to the extent funds have it, has the highest level of discretion and immediacy for a GP: a GP’s mandate should enable them to follow their investment within existing agreements with their LPs.

Single asset SPVs. Almost every LP under the sun asks for co-investment agreements. But not every LP is set up to diligence specific direct opportunities, and even fewer LPs can move quick enough to be able to take advantage of fast-moving rounds. Nevertheless, GPs can spin up SPVs to source capital to follow their initial capital. SPVs can generate additional fees & carry for the GP, but fundraising is time consuming and chasing LPs to complete an SPV is like herding cats.

Opportunity funds. The third established option is to created a dedicated pool of discretionary capital to finance follow-ons for existing portfolio companies. The pitch here to LPs is to increase exposure to break out portfolio companies which are on a clear path to an IPO. Or, at least, that was the pitch. In fact, such was the power dynamic between LPs and GPs during the go-go years of 2020/21 that many GPs stapled opportunity funds to their core fund and demanded that LPs commit to the opportunity fund to secure an allocation in the core fund.

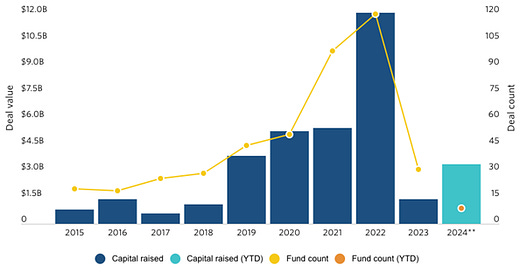

With the paucity of IPOs and amid a challenging VC fundraising environment, LPs’ appetite for opportunity funds has largely disappeared. Pitchbook has shown how the number of successfully raised opportunity funds is at a 10 year low (Figure 4.).

Figure 4. US VC fundraising for funds with ‘opportunity’ or ‘select’ in name

Some GPs are going even further and actually abandoning their opportunity fund strategies entirely. Last month, CRV returned more than 50% of its $500m opportunity fund, citing its inability to deploy the capital at attractive valuations.

An alternative model: the opportunity for pro rata funds

Pro rata funds do exactly what they say on the tin, financing the pro rata funding of GPs in subsequent rounds for their portfolios. So, a GP might buy 10% of a startup at the seed round, and then the GP might use their reserve capital at the Series A to maintain their 10% ownership. But, by Series B, the GP has exhausted their reserve capital, does not have an opportunity and cannot commit the time to spin up a SPV. In these circumstances, a pro rata fund can step in to continue to finance the GP’s pro rata (with a proportion of the upside going to the GP).

TechCrunch recently wrote about the rise of pro rata funds. As well as SignalRank, the main players are Alpha Partners, MDSV, PROOF and SaaS Ventures.

From a GP’s perspective, pro rata funds are outsourced opportunity funds which offer all the benefits of an opportunity fund with none of the downsides. In other words, GPs can continue to support their portfolio companies (including the ancillary signaling benefits) while protecting their fund metrics and spending zero time on fundraising for follow on capital. This product is particularly compelling when the market for opportunity funds is effectively closed.

As a result, we have remarkably clear product-market fit. By offering 20% deal by deal profit share (so if we invest $1m, we would pay the GP $1.8m profit for a $10m exit that resulted in $9m profit) and rapid speed of execution (where we can complete within a week and do not need to meet management), our product has appeal within the GP community. We are currently partnering with 200+ seed managers. We have closed 20+ high quality Series Bs since May 2023.

Concluding thoughts

The venture capital market is evolving with ever more distinct product offerings from LPs and GPs alike. At SignalRank, we believe that the stratification of investment products is a demonstration of market maturity, where underlying investors have a broader set of options which reflect the risk/return profile they are seeking. Allocators can support GPs with zero reserve strategies, GPs with 1:1 reserve strategies and GPs with opportunity funds. Allocators can invest direct into single asset SPVs. At the same time, allocators can invest into pro rata funds which focus exclusively on breakout companies that are sourced from a broad network of some of the best GPs in the world.