We are excited to share here our updated report on the state of the Series B ecosystem, with H1 2025 data.

The SignalRank Index reflects the top 5% of Series Bs in terms of MOIC potential. As such, understanding the Series B ecosystem is critical to our business model.

In this post, we will consider key trends in the Series B ecosystem in H1 2025.

We hope you enjoy the report.

Executive summary

AI continues to be the core focus: AI is absorbing an increasing proportion of Series Bs, both in terms of number of rounds and capital raised.

The number of Series Bs has stabilized, the average $ raise is rising: the number of Series Bs closed globally per month has remained flat for the last two years at ~100 per month. Beyond AI, the other sectors which continue to attract quality capital are defense (e.g Mach Industries) and FinTech (e.g Savvy Wealth).

US retains capital density: the most active Series B investors (A16Z, General Catalyst, YC, Khosla & Lightspeed) are increasingly focused on US companies. 100% of A16Z’s 2025 Series Bs to date have been in the United States.

Promising signs for liquidity: Series Cs, like Series Bs, remain flat in terms of number of rounds. A bright spot has been higher levels of M&A and IPOs, showing promise for the rest of the year

SignalRank deploys at target cadence: SignalRank invested in 16 Series Bs (of which 9 have been announced) in H1 2025, making SignalRank one of the most active Series B investors globally.

Preliminary conclusions from the report

AI companies command premium valuations & capital raises

The overall number of Series B rounds has remained flat over the last two years, while the average & median amount raised continues to rise (Figure 1).

This data is a reflection of how it is primarily AI companies that are raising more rounds, larger rounds, at higher valuations and from higher quality investors than their non-AI peers (Figure 2).

Figure 1. Global number of Series Bs per month & average Series B raise

Figure 2. Median pre-money valuations & capital raised in 2025

The most active investors are focused on US AI companies

Andreessen Horowitz & General Catalyst were the joint most active Series B investors in H1 2025, each with 16 Series Bs completed & announced (Figure 3). At SignalRank, we have closed 16 investments too in H1 2025, of which 9 have been announced and a further 7 remain unannounced.

Figure 3. Most active Series B investors in 2024 (by # of announced investments)

The most notable shift compared to 2024 is a concentration on US companies, with 100% of Andreessen Horowitz’s Series B investments in US companies. Similarly, the most active investors over index on AI relative to the overall market (Figure 4).

Figure 4. Analysis of top 5 most active Series B investors in 2025

Growth investing remains subdued, while liquidity starts to return

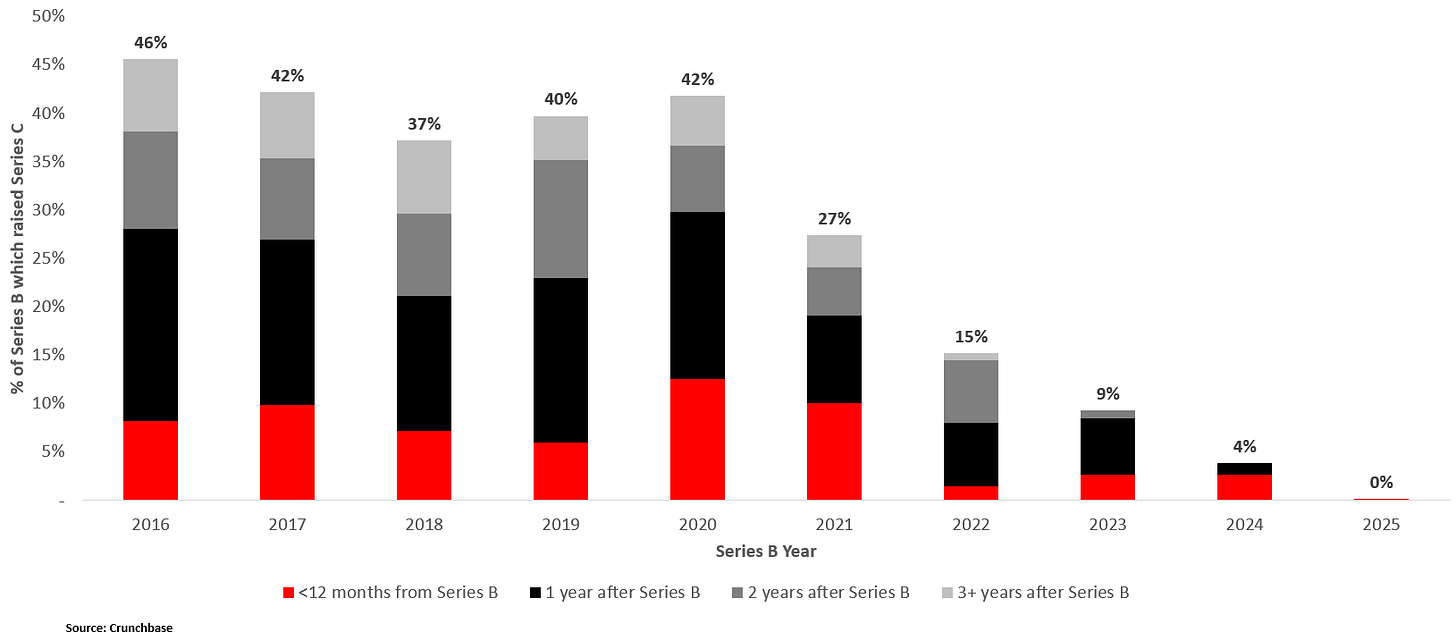

Series C conversion remains subdued (Figure 5). <10% of Series Bs are raising Series Cs within two years (compared to c.30% in pre-2022 years).

Figure 5. Percentage of Series Bs which raise a Series C

It is worth noting that qualifying Series Bs (for SignalRank’s product) continue to raise Series Cs at an elevated rate relative to the overall Series B mark (Figure 6).

Figure 6. % of Series Bs which raised Series C (2012-25)

A more positive development has been higher levels of M&A and IPO activity, showing promise for the rest of the year. Four recent IPOs delivered compelling returns for their respective Series B investors (Figure 7).

Figure 7. Series B returns (based on Series B share price) from select 2025 tech IPOs

Concluding thoughts

The Series B market has stabilized into a new post-ZIRP AI-focused rhythm.

The pace at which AI companies can scale has moved the goalposts for companies seeking to raise quality Series Bs. It is no longer unusual to see companies scaling to $100m “ARR” within two years of formation. In turn, this has led to higher valuations for strong companies at the Series B.

AI should enable such productivity gains that companies are able to achieve cashflow breakeven with less capital than in prior cycles.

It is perhaps surprising then to see that the way in which companies are raising capital has not really changed. The alphabet soup continues. Fundraising is more a reflection of supply/demand than anything else. And possibly a reflection of VCs’ unwillingness to consider a shift in pattern recognition away from staged funding at seed / Series A / Series B / etc.

Perhaps more surprising still is the concentration on companies based in the US. European sojourns have come to an end for select major VCs, who are doubling down on the Bay Area (with A16Z & Coatue, for example, recently closing up shop in London). The Generalist is today imploring successful European founders to unretire.

Finally, we are pleased to see that recent liquidity has brought some optimism back into the broader venture market. We hope to see this continue into the second half of the year.