State of the Series B ecosystem

"Investing is simple, but not easy" - Warren Buffett

Introduction

We are excited to share here our inaugural report on the state of the Series B ecosystem.

SignalRank seeks to identify (and invest in via our seed partners) the top 5% of Series Bs in terms of MOIC potential. As such, understanding the Series B ecosystem is critical to our business model.

In the report, we unveil the intricate tapestry of the Series B ecosystem to share a high level view of current trends for Series B investors. In this post, we present a distilled summary of the report's core findings, offering preliminary insights into the implications that these trends hold for the broader venture ecosystem.

We hope you enjoy the report.

Why write this report

The motivation behind this report stems from a desire to bridge the gap between the prevailing gloomy sentiment in venture capital discourse and the realities that the 2023 Series B data presents. Contrary to the downbeat narrative, the data tells a different story, showcasing a resilience that has often been overshadowed.

Our industry seems to want to benchmark 2023 to the 2021/22 years, where 2023 is of course much slower because of the broader macro context, but a longer term view suggests that the level of activity is not as subdued as implied.

This is not to argue that we are necessarily bullish on Series Bs, but hopefully more realistic. This is also not to minimize the pain happening under the surface in terms of down rounds / companies shutting down (and very few folks announce down rounds / convertibles, so this data is hidden).

Some broader context

In August 2023, it is axiomatic to argue that there is significant uncertainty in the venture market.

We find ourselves amid an interregnum period, the outcome of which could have profound impact on the future dynamics of the venture industry. The key drivers in shaping the future direction of the industry are complex, multi-faceted and connected, including but not limited to:

A challenging macro environment. Venture benefited from a benign macro environment since 2008 with cheap capital powering multiple expansion in the public markets for technology stocks. This came to an abrupt end in 2022 with higher inflation and rising costs of capital, making capital more scarce for growth assets (including venture). As at August 2023, the market is now starting to price in rate cuts for next year. But will this lead to the venture taps switching back on? And to what level?

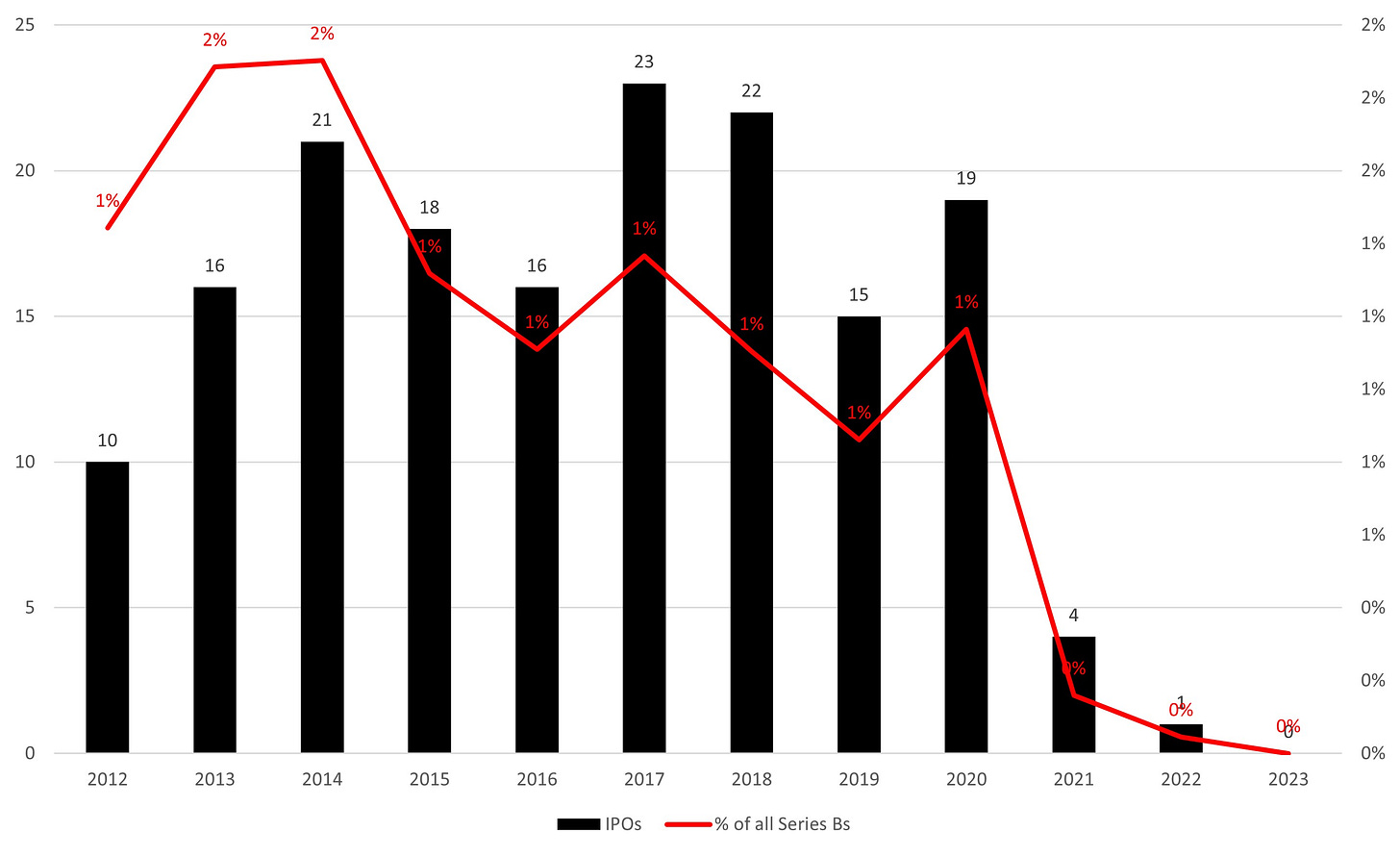

Venture has become over capitalized. Our report shows how the number of companies which IPO per Series B cohort has remained fairly consistent (10-20 per annum) since 2012. Yet the number of companies receiving venture capital has been growing every year for at least the last ten years at every stage (where we may be witnessing a reversion to mean numbers after the pandemic). This glut of capital has led to two major issues as the macro environment has turned:

there are too many companies chasing a smaller amount of capital. The metrics for raising the next up round are increasingly challenging.

cheap capital has fueled “growth at all costs” cultures within companies which are going to be very hard to realign to the new “cashflow breakeven first, growth later” mentality.

Many companies will simply not be able to navigate through these choppy waters.

No recycling of capital into venture as liquidity dries up. The tightening of capital markets has been exacerbated by the freezing of the IPO market, thereby restricting LPs to recycle capital from old vintages into new fund vintages. A successful IPO by Arm will be critical to more companies lining up in Q4 2023 and Q1 2024. In addition, a more hostile stance to “Big Tech” M&A by regulators (on both sides of the Atlantic) has reduced further the liquidity options available to allow capital to flow back into the venture system.

Questionable venture returns from emerging technologies. A gross simplification of the success story of the venture industry over the last fifteen years would be to argue that investors have leveraged cheap capital to develop US-led playbooks of business model innovation for high margin software powered by cloud computing (ie SaaS). The question looking forward is where is the source of future venture-scale returns:

Many antiquated / heavily regulated industries remain underpenetrated in terms of SaaS. Yet a lesson from the last few years (now that the cheap capital has dried up) is that many of these markets are smaller and harder to penetrate than expected. One interpretation of the drop in the number of Series A & B rounds from 2018 onwards (albeit interrupted by the cheap money during the pandemic), could be that mobile & cloud penetration struggled to cross the chasm into more challenging industries. As these sub scale vertical SaaS companies falter, acquiring product suites from Big Tech is likely once again a more attractive solution for many customers.

Artificial Intelligence is clearly a platform for future innovation. Yet there are three immediate questions here: i) what is the capital intensity required to build a product with a moat? ii) will value be captured by these startups or to Big Tech? and iii) when can significant revenue generation be expected?

Combined software & hardware sectors (such as defense and climate tech) are in vogue, but likely more capital intensive than expected and likely lower margin than forecast. Are we watching the re-run of the cleantech saga of the early 2000s?

Venture has become global but political. Multiple ecosystems around the world have developed their version of Silicon Valley with varying levels of success. This has led to a flourishing of startups and investors across multiple continents. Yet the centrality of technology (in part powered by venture capital) to society now has elevated its importance in geopolitical terms. A more fractured geopolitical landscape, where the direction of travel appears to be for ever greater dislocation, will have significant implications for the venture industry (e.g. “reverse CFIUS”, Biden’s executive order banning certain investments by US investors in China).

It is this backdrop (as well as short term memories that do not allow journalists / Twitter thinkbois to see before 2021) that has led to shrill commentary on the woeful outlook for venture. And yet the Series B ecosystem appears to be remarkably resilient in 2023 as we will see…

Why focus on Series Bs

SignalRank is a systematic investment company that leverages data to identify the highest potential Series Bs which we access by financing the pro rata positions of existing seed investors. Why is the Series B round SignalRank’s exclusive entry point?

A “Series B” demonstrates product market/fit.

It is received wisdom that the Series B round is the most challenging to raise because investors are seeking to establish whether or not the company has achieved product/market fit.

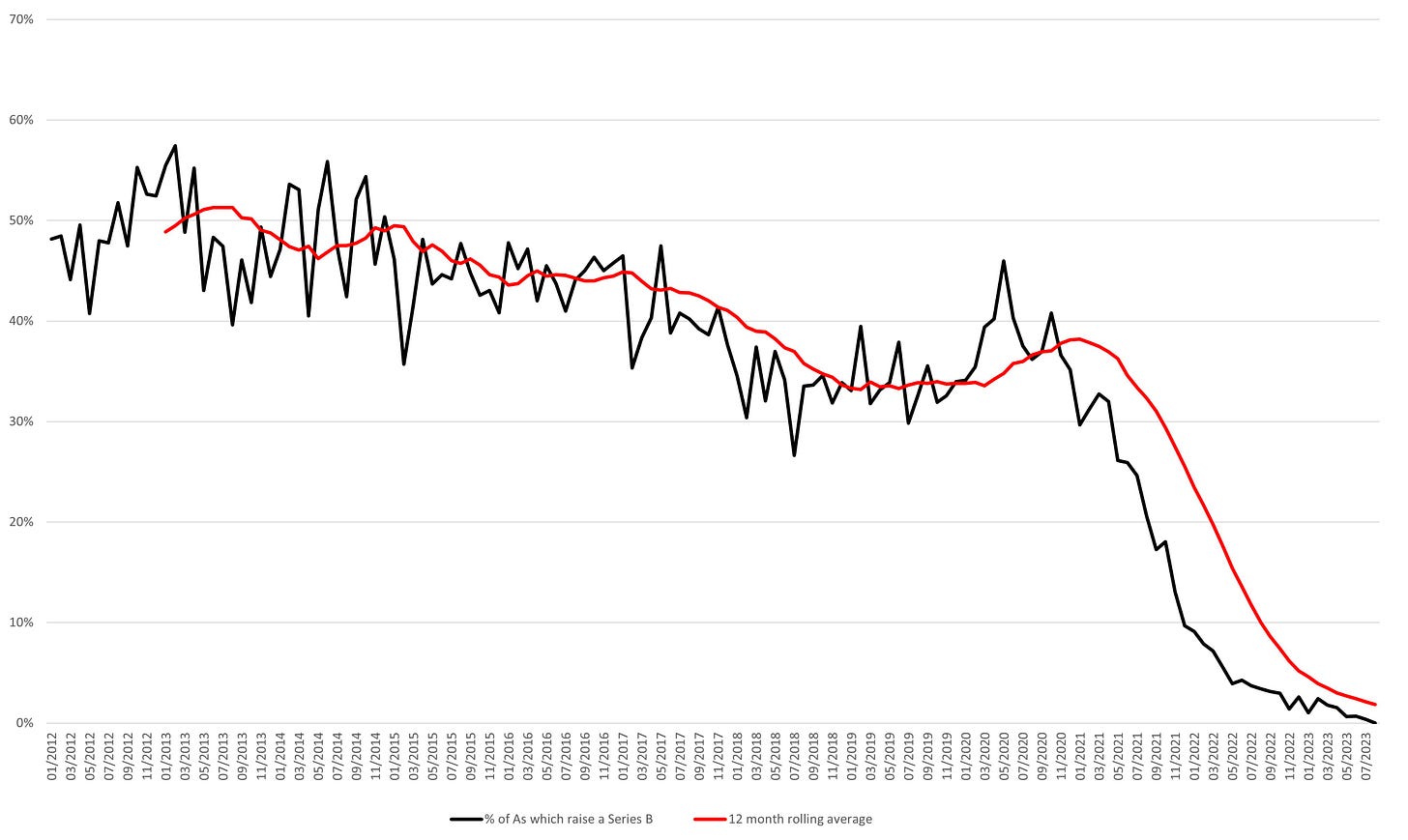

We believe that announcing a “Series B” has positive connotations because the market understands that this represents a company establishing product/market fit. Most Series A companies do not raise Series Bs (c.65% per our report). A “Series B” puts a company into a distinct subset of the ecosystem compared to companies raising a Series A extension / plus.

Our algorithms at SignalRank are designed to establish whether the “Series B” is indeed a marker of potential, or simply a heavily disguised bridge round.

Compelling returns with minimal post IPO risk

A Series B investor is still participating early in the life of a company and can benefit from power law dynamics. 20x+ returns from Series B are eminently achievable.

Series Bs also tend to be insulated from post IPO risk which impacts later rounds, especially where investors are subject to post IPO lockup periods. Even in companies which have performed poorly as public companies, Series B investors have seen tremendous returns.

Sufficient data for a risk-adjusted quantitative approach

A Series B is usually at least the third time that the company has been vetted by investors. This is particularly useful for our approach as our algorithms focus exclusively on investor patterns & behaviors.

Our methodology uses data from at least three rounds (pre A rounds, Series A rounds, Series B rounds) to identify high potential companies.

With this approach, we can increase the probability of investing in a unicorn from Series B to c.30% (versus <10% for the market average). Our back tests show this approach leading to a 2x+ return for our investors relative to the market average.

Sizeable pro rata allocations for seed investors

Series B round are typically the round where it becomes problematic for seed investors to maintain their pro rata stakes, allowing for opportunistic growth investors to acquire larger stakes in Series B companies.

99% of seed managers do not have opportunity funds. SignalRank aims to empower these seed managers by enabling them to maintain their pro rata in their winning companies.

At the same time, the Series B round is still early in a company’s lifetime, with seed investors typically still playing a somewhat meaningful role. SignalRank allows these seed managers to maintain their voice in the company for longer by retaining their stake at pro rata levels.

Some preliminary conclusions from the report

Series B resilience

In spite of the macro backdrop, the Series B ecosystem has remained remarkably resilient in 2023:

Number of rounds: The hangover from 2021/22 is real (with annualized 2023 # of Series Bs 38% lower than 2022, or 45% lower than 2021). Yet a longue durée view demonstrates that the number of Series Bs is in-line with 2015/16 levels of activity (with c.1,400 Series Bs anticipated this year on an annualized basis).

Size of rounds: The median Series B of $27m is the highest it has ever been (except 2021/2022). There have been 50+ Series Bs in 2023 with a round size of $100m+ (and 150+ with a round size of $50m+)

Quality of investors: high quality investors are leaning into Series Bs in 2023 (A16Z is the most active Series B investor this year with 12 investments YTD)

Chart 1. Number of global Series Bs per month (2012-2023)

Source: Crunchbase

Hidden pain

The venture ecosystem has been intoxicated by cheap capital, particularly in 2021 and 2022. There are likely significant repercussions for this which have not yet been fully felt. Now in 2023, the pain of lower valuations (and the implications thereof for investors / employees) is yet to be absorbed, with many 2021/22 investments still not fully marked to market.

In particular, too many companies raised too much capital in 2021 and 2022. Given the size of these rounds, many have not yet been forced to come to market to raise again. And it will be harder for them to raise this capital. Fewer Series As as a % of each Series A cohort will raise Series Bs.

Most insider rounds / down rounds / bridge rounds / shutdowns are not announced. Our dataset is unabashedly optimistic in only showing the first priced rounds at each stage (Series A, Series B, Series C). In fact, we believe this is an advantage at SignalRank to exclusively focus on the first priced Series B because we believe it is positive news to raise a “Series B” (as long as it is not a heavily disguised bridge round).

Chart 2. Percentage of Series As which raise a Series B (Series A date shown, 2012-2023)

Source: Crunchbase (2021 & later cohorts are not yet fully mature)

Series B consistency

The Series B ecosystem has consistently delivered c.10-20 IPOs per annum for every cohort since 2012 (until 2021 Series Bs which have not yet had sufficient time to mature). Again, in terms of unicorn production, each Series B vintage has created 100+ unicorns since 2014 (until 2022). Given the rise in the number of Series Bs over the last decade, it has become increasingly hard for investors to find these top performing companies (1% of Series Bs go on to IPO).

Chart 3. IPOs created per vintage of Series Bs (Series B date shown, 2012-2023)

Source: Crunchbase

Birth of the new

Quality shines through. Raising a Series B in this environment is hard. But c.10% of the October 2021 cohort of Series As has already raised a Series B today. There have been almost 1,000 Series Bs year to date. Investors are putting capital to work into the next cohort of unicorns.

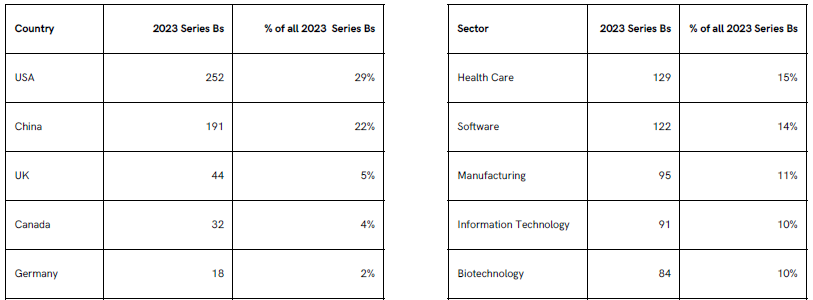

We see this capital being invested globally (with only 29% of Series Bs in the US YTD) and into sectors historically underpenetrated by technology. The number of Series Bs into health care and manufacturing in particular is noteworthy (and the relative absence of consumer-facing Series Bs). And yes, of course into AI (69 companies are in the AI sector, or 8% of all Series Bs).

Table 1. Top 5 most active geographies & sectors for 2023 Series Bs

Source: Crunchbase

SignalRank algorithms perform

The power law dynamics of venture ensure that venture capital is a poor asset class for all but the best investors, even in the best of times. In this more challenging environment, it is even more essential for investors to be able to discern quality.

Our algorithms seek to identify the top 5% of all Series Bs by selecting companies backed by the best investors at each stage. By looking at the number of companies selected by SignalRank as a % of all Series Bs, it is possible to see how the market began to overheat in H2 2020. (SignalRank's investment strategy adjusts when the algorithms are selecting more than 5% of all Series Bs in a given month).

In 2023, of the c.1,000 Series Bs YTD, our algorithms have selected only 46 as having sufficient signal to qualify for our product.

SignalRank started investing in May 2023, with 5 investments already completed (alongside co-investors such as Sequoia, Accel, Lightspeed, A16Z and others) and a further 4 expected to complete by September 2023.

We are aiming to make 30 Series B investments per annum (accessing c.25-30% of these qualifying Series Bs in the whole market).

Chart 4. New SignalRank Index companies as % of all new Series Bs per month (qualifying Series Bs, 2013-2023)

Source: SignalRank

Some concluding thoughts

We are optimistic on the 2023 vintage of Series Bs given some of the dynamics described above and given SignalRank’s approach to this market. It is in these more uncertain environments that real value is created.

Thank you to everyone who has read a draft of the report and provided valuable feedback (especially Thomas, Gabriel, Arjun, Ben & Kenny).

We hope this to be the first of such reports. In the meantime, please do share your feedback / questions: team@signalrank.co