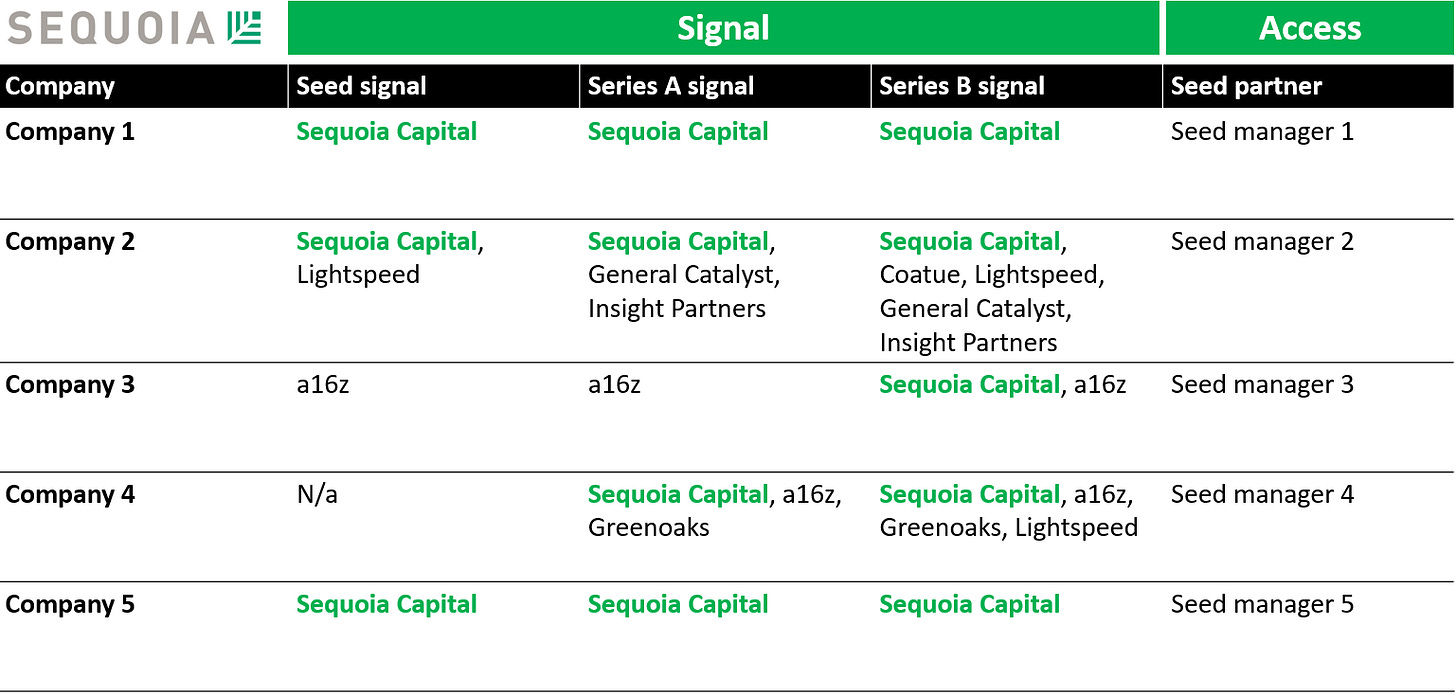

Figure 1. SignalRank’s 2025 Series B investments with Sequoia Capital as a co-investor

Source: SignalRank. Only multi-stage firms shown as signaling investors to maintain confidentiality and for simplicity; strongest signal at seed tends to derive from (pre)seed specific managers, not multi-stage firms.

There is a distinction between signal & access in SignalRank’s model.

Signal for qualifying Series Bs derives from investor scores from multiple investors across multiple rounds, whereas access derives from undercapitalized existing investors seeking to defend their ownership.

In other words, SignalRank is supporting emerging seed managers, not famed multi-stage funds.

The typical pattern is for a seed manager to back a company at an earlier stage before a deeper pocketed fund leads the Series B. SignalRank is supporting the seed manager by financing their pro rata, thereby reducing the impact of dilution delivered by a large check in subsequent rounds.

This model is particularly clear when we look at companies we have invested in this year where Sequoia Capital is a co-investor in the Series B.

Unsurprisingly, Sequoia ranks highly on our model as a Series B investor. But, again unsurprisingly, Roelof is not speed-dialing us to request capital to finance his pro rata in these rounds.

We have invested in five Sequoia-backed qualifying Series Bs so far in 2025 (and in nine Sequoia-backed Series Bs in total across all vintages, ~25% of all our investments). Our access has derived from five different seed managers in these 2025 companies. Pro rata is a problem for essentially all early stage investors, and they are looking to defend their position in their winners.

It is also worth noting that qualification requires high scores across all of seed / Series A / Series B rounds. So our model is not simply a function of qualifying every Sequoia-backed Series B (as the model takes into account seed & Series A investors, as well as other Series B investors). Sequoia has invested in 24 announced Series Bs in the last two years, of which 21 would have qualified for our model.

Alas none of the 2025 co-investments with Sequoia is public yet. But Figure 1 above is a simplified demonstration of how signal is distinct from access.