How capital concentration impacts Series Bs

Considering Series B investments by a16z, Sequoia, GC and LSVP

The capital concentration in venture continues apace. This trend recently came into sharp focus again last week with a16z announcing their $15bn fund, representing 18% of all US dollars raised by VCs in 2025.

We previously wrote about the rise of the venture majors (a16z, Sequoia, GC and LSVP) as asset managers who have outgrown the venture category.

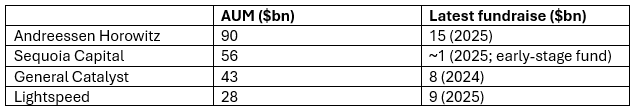

For those of you keeping score on AUM and latest fundraises:

This post looks again at these four managers to see how they are investing specifically at Series B. How does this concentration of capital manifest itself at the stage where SignalRank invests? And if SignalRank over indexes on companies backed by the venture majors, what does that mean SignalRank investors are buying?

As well as looking for Series Bs backed by the best investors in the world, SignalRank is simultaneously seeking to support the seed manager ecosystem by financing the pro rata of early stage managers. A subsequent post will consider how the concentration of capital in the venture majors is impacting seed investors.

All Series Bs

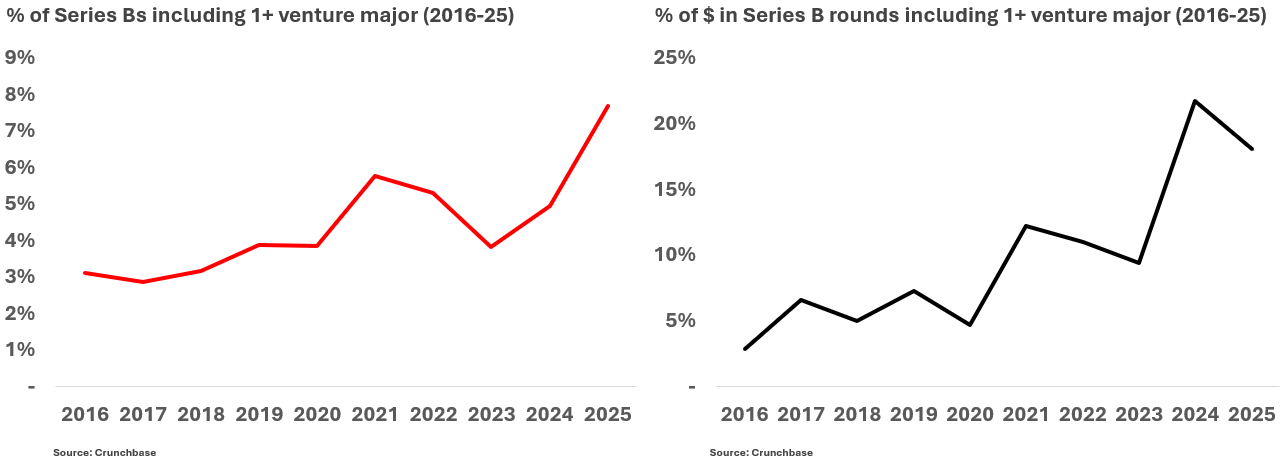

The % of Series B rounds including one or more of the venture majors has doubled in recent years to 8% of all Series Bs globally. Similarly, the % of Series B dollars in rounds including one or more of the venture majors has doubled in recent years to ~20% of all dollars raised at Series B rounds.

Figure 1. Venture majors as % of rounds and capital in all Series Bs (by Series B year)

Qualifying Series Bs

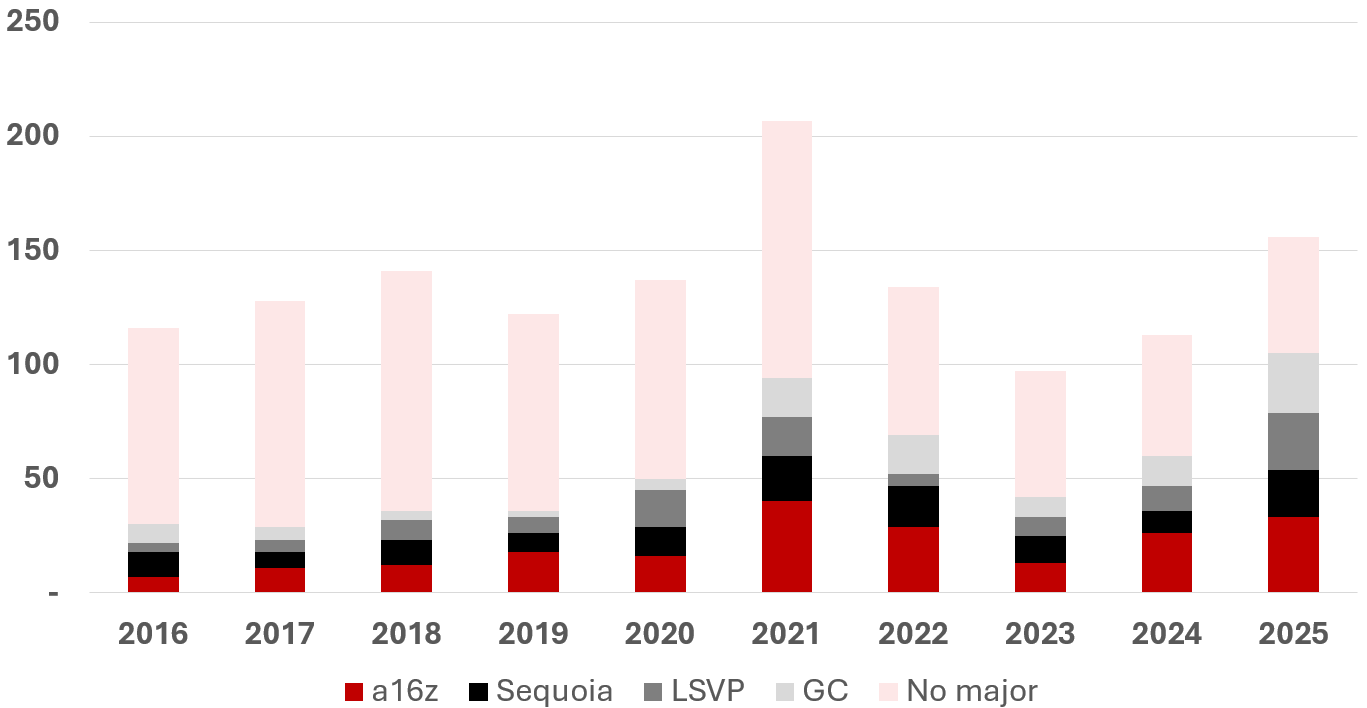

SignalRank is aiming to invest in the top ranked companies at Series B, where we score and rank the investor syndicates at seed, Series A and Series B.

If we just look at these companies, the concentration in the venture majors is starker still. The % of qualifying Series Bs with a major is now 60%+, which is a 3x increase in the last ten years (Figure 2).

By looking at dollars invested, the concentration is even stronger. 71% of capital in qualifying Series Bs is in rounds with one or more of the venture majors.

Figure 2. Number of qualifying Series Bs by venture major participant (2016-25)

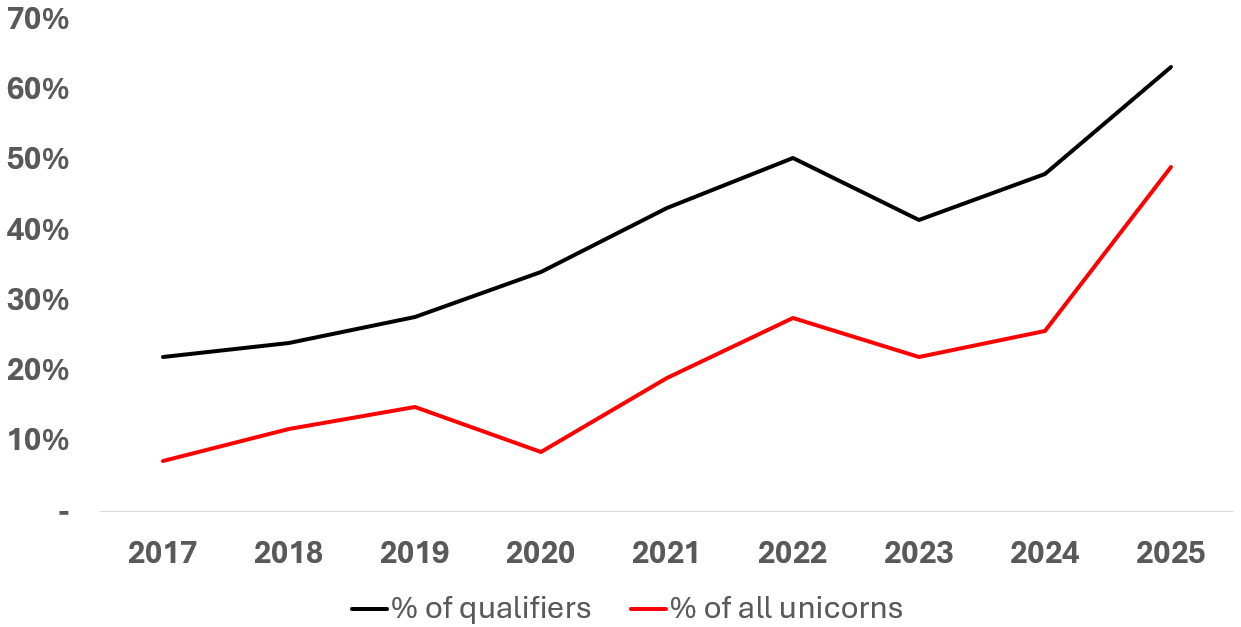

The concentration of venture majors in qualifiers correlates closely with unicorn generation (as a poor proxy for power law return generation; all power law companies are unicorns but not all unicorns are power law companies).

Almost 50% of all Series Bs where the company went on to become a unicorn saw one or more of the venture majors invest in the Series B (compared to 10% ten years ago, Figure 3).

Figure 3. % of all qualifying Series Bs with a venture major (and % of all Series Bs, both qualifying and non-qualifying rounds, which became unicorns where venture major invested in Series B)

How should we interpret this last chart? What does this mean for SignalRank?

You might argue that our qualification engine over indexes on the venture majors relative to their contribution in unicorn production. But almost 50% of all unicorns now come from venture major Series Bs, so you could do worse than co-investing with the venture majors. An alternative interpretation is that SignalRank is just a diversified portfolio of some of the venture majors’ Series B investments.

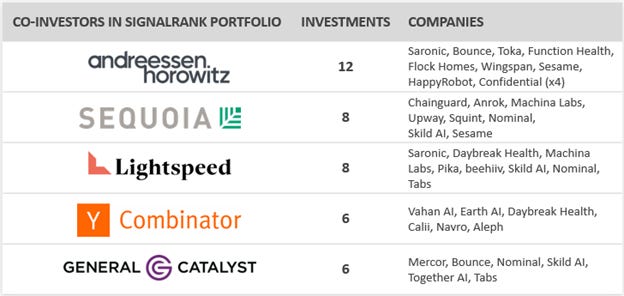

It is true that our most common co-investors are the venture majors (Figure 4). On the other hand, we have no dependence on any single one. SignalRank offers a way for investors to achieve exposure across the venture majors’ Series B investments.

Figure 4. SignalRank’s top co-investors from our 45 investments to date

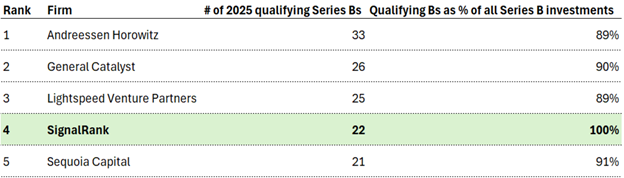

We also do not “just follow” venture majors. We are scoring each round, and a qualifying Series B company must raise quality rounds at each of seed, Series A and Series B. Indeed, not every venture major Series B investment qualified for our product (Figure 5).

Figure 4. Most active investors in qualifying Series Bs in 2025 (by # of investments)

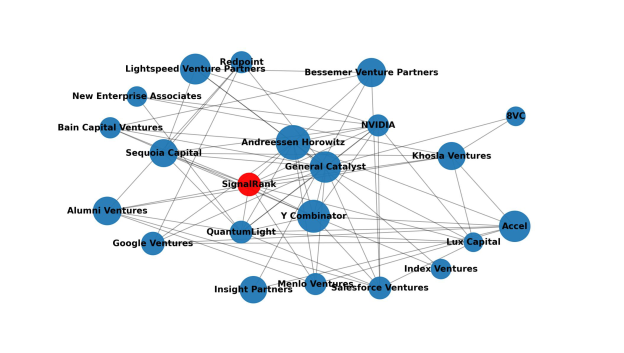

A fairer interpretation is that we are offering smart beta of high quality Series Bs, with SignalRank demonstrating high network centrality. Figure 5 shows how investors are co-investing at Series B in 2025.

Figure 5. All investors with 10+ 2025 Series B investments, with edges showing 2+ co-investments

In summary, high quality Series Bs are increasingly concentrated around the four major venture investors. At SignalRank, we see this by considering the percentage of all qualifiers (on our methodology) where these four investors are present. In turn, this means that SignalRank’s offering is a means for allocators to access exposure to Series B investments by these top investors.

Really sharp analysis on VC concentration. The data showing 71% of capital in qualifying Series Bs now flows through these four firms is pretty striking, and I dunno if most founders realize just how much the landscape has narrowed. It raises interesting questions about wheter this creates blind spots in what gets funded.