Mapping the rise of closed-end VC funds

Or, considering the Galáctico approach to portfolio construction

What do BlackRock’s Larry Fink, Benchmark’s Everett Randle and SaaStr’s Jason Lemkin have in common?

They all believe that a tsunami of retail capital is coming to the private markets: here, here and here.

But retail participation isn’t simply a question of demand. It’s a question of structure. All investors seek transparency, simplicity and liquidity. Retail investors even more so.

What is the right structure to enable retail investors to participate in venture capital?

Increasingly, the answer is closed-end funds (“CEFs”).

SignalRank has previously written about how to index venture capital, and why, in our view, the potential for asset liability mismatch makes interval funds a poor structure for venture allocators (not that this has stopped Ark, Stepstone and others).

Instead, we are seeing more managers opt for an exchange traded CEF model. DXYZ & Flat Capital have this structure, as will the recently announced Robinhood Ventures and Powerlaw Corp. SignalRank is actively exploring this path forward as well.

Why is this trend happening? And how would SignalRank differentiate itself from these other CEFs?

Why are we seeing growth in CEFs?

The main reason for the rise in closed-end funds is preparation for the surge of retail capital about to hit alternatives, including venture capital. Mutual funds cannot hold much illiquidity, ETFs cannot hold private assets, and GP/LP funds cannot take retail money. CEFs fill the regulatory gap.

An equally important facet of CEFs is its attractive liquidity profile. As permanent capital structures, shareholders are trading shares in the CEF, not in the underlying portfolio itself. As a result, CEFs can hold illiquid private assets without daily redemption risk; there is no potential for liquidity mismatch. But, at the same time, retail investors benefit from daily tradeable shares for exchange traded CEFs.

CEFs also have a lower regulatory burden in some areas, notably in the marketing of the fund. CEFs can be marketed much more broadly to potential investors, facing fewer regulatory constraints around solicitation than a traditional VC fund. Similarly, CEFs have more flexibility in what they can invest in relative to BDCs (which have increasingly become vehicles for private credit managers).

Finally, the share price of CEFs is driven by supply/demand rather than tied explicitly to NAV. This dynamic is often misunderstood and can allow CEFs to trade more freely in-line with the market’s view on valuation. In some cases, notably DXYZ (which has a high concentration in SpaceX) and Flat Capital (which has high concentration in OpenAI and Klarna), CEFs can trade at a significant premium to NAV.

In short, the CEF is an attractive structure in the US regulatory system for private-asset retail investing.

So how do these CEFs compare?

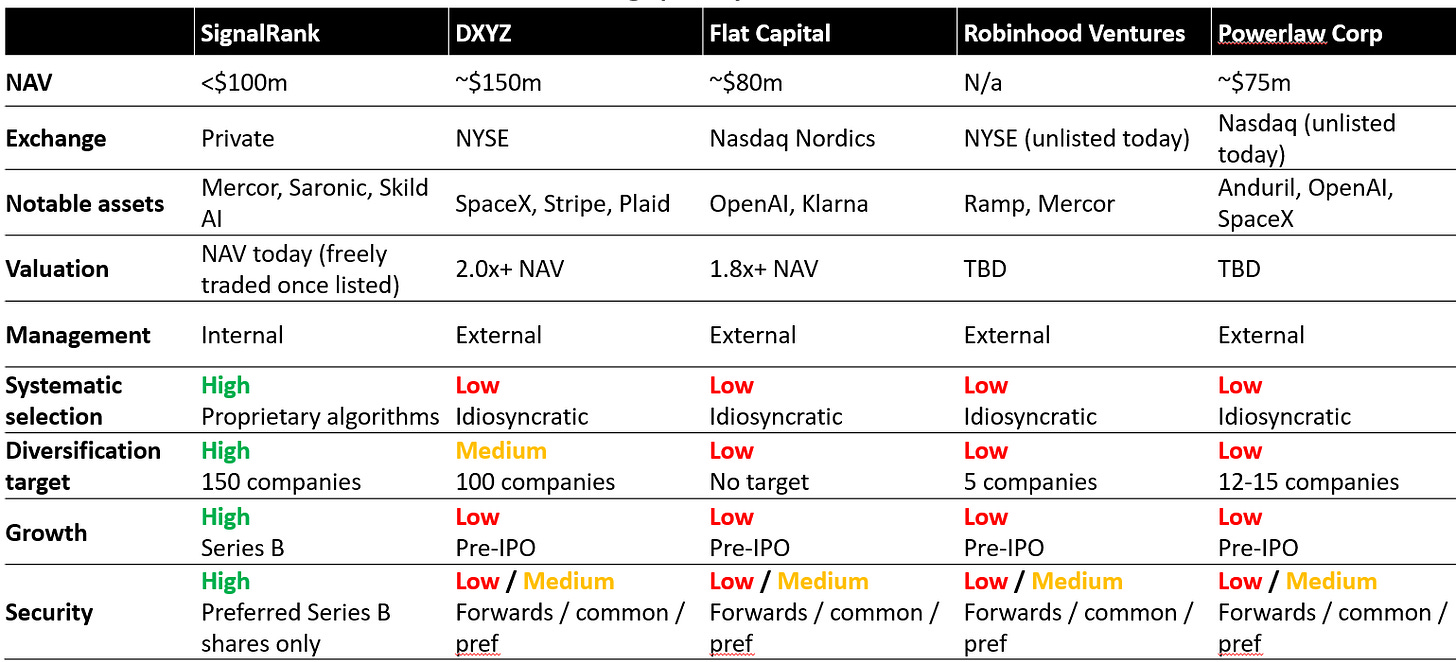

Figure1. Comparing SignalRank to live CEFs

The live CEFs today, especially DXYZ and Flat Capital (shown in Figure 1), are focused on creating more concentrated portfolios of well known pre-IPO assets. It’s a compelling strategy.

The current CEFs today are following Real Madrid’s Galáctico model of portfolio construction, acquiring the biggest global stars. Just as Real Madrid acquired Zidane, Ronaldo and Beckham at the peak of their powers, so the current crop of CEFs have a star-name concentration strategy designed to appeal to retail investors, albeit potentially at the expense of likely future growth, portfolio balance and diversification.

The commercial success of Real Madrid in the last 20+ years has been undeniable. Similarly, the CEFs’ focus on the SpaceXs /OpenAIs of the world no doubt has a strong pull, as reflected in the fundraising success and premium market value of some of the above CEFs.

By way of contrast, and to continue the soccer analogy, there is another model. SignalRank is aiming to build more along the lines of the Barcelona school of thought. The Catalan team famously sought to prioritize its system into which home-grown talent (including Messi, Xavi and Iniesta) could flourish to deliver more consistent and repeatable results.

If SignalRank were to list itself, it would occupy a distinct market position across five dimensions:

Management: internal management aligns incentives for long-term compounding (rather than AUM accumulation)

Systematic selection: a rules-based data-driven approach reduces idiosyncratic manager bias

Diversification: a portfolio of 150 companies (30 investments per year) distributes risk more effectively than concentrated “star” portfolios.

Growth: Series Bs demonstrate high multiple return potential

Security: direct ownership of preferred Series B stock, rather than common or forwards, provides cleaner cap table exposure

SignalRank would be the only venture-focused CEF designed to systematically index the Series B layer of the venture ecosystem. It would complement late stage CEFs.

¡Força SignalRank!