2023 in review

Series B Rounds 2021-2023

Carta’s Peter Walker publishes some fabulous stats on venture funding. Thanks to Peter for the inspiration.

I thought it might be a useful exercise to compare SignalRank’s 2023 Series B data with Peter’s data. Peter bases his numbers on Carta’s USA based companies. SignalRank tracks global rounds, but I have broken out the USA to get a better comparison. This Google Sheet has the data.

Number of Series B Rounds

The number of SignalRank tracked Series B Rounds 2021-2023 is:

2,823 in 2021 --> 2,361 in 2022 --> 1,454 in 2023

When focusing on USA only as Carta does the numbers are:

1,262 in 2021 --> 959 in 2022 --> 507 in 2023

The number raising $50m or more is:

688 in 2021 —> 495 in 2022 —> 228 in 2023

When focusing on USA only as Carta does the numbers are:

373 in 2021 —> 247 in 2022 —> 123 in 2023

SignalRank’s Index Series Bs are a high scoring subset that our algorithm qualifies for investment based on seeking an average 5 Year MOIC of 5x and 25-30% Unicorns.

For global Series B Rounds the Index numbers are:

479 in 2021 —> 378 in 2022 —> 198 in 2023

When focusing on USA only as Carta does the Index numbers are:

339 in 2021 —> 269 in 2022 —> 143 in 2023

The 2022→2023 change is very uniform across each grouping.

Median Amount Raised

The Median Raise shows carta company’s are lower than those SignalRank tracks. The SignalRank Index rounds typically raised more capital than the market norm (The SignalRank Index represents high scoring Series B Rounds that Qualify for SignalRank to Invest in on behalf of our Seed and Series A Partners).

A greater percentage of SignalRank Index comapnies raised $50m or more.

Gross Capital Raised

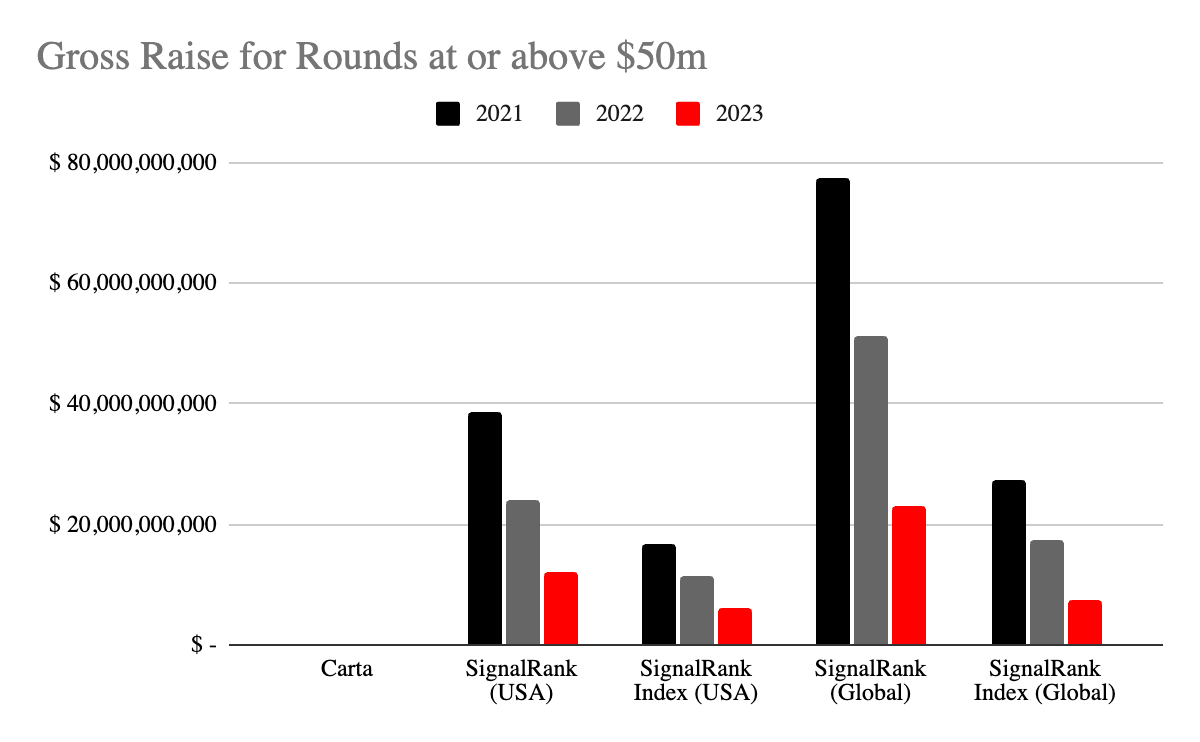

All cohorts experienced similar declines year over year in the gross capital raised at Series B. This is true for all rounds, and for those above $50m.

Those companies raising $50m or more had the following Gross Raise:

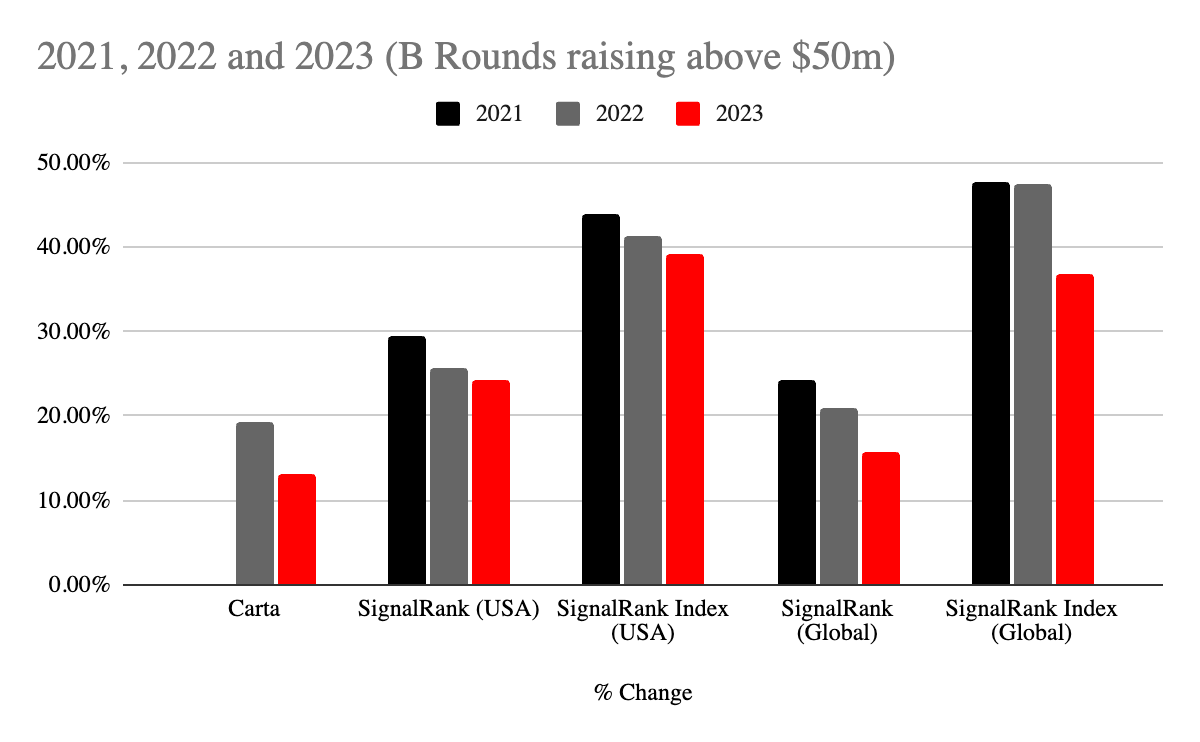

Looking at annual change measured by the fall-off between years the following charts show what % of the prior year was raised in the current year. These numbers are somewhat consistent between cohorts.

The conclusion is the same sobering conclusion as Peters - Less capital is being invested at Series B in less rounds. However the median amount raised per round is less impacted. In the case of the SignalRank Index Series B rounds for US based companies the median raised is actually trending upwards for those raising above $50m.

We expect 2024 to begin to reverse these trands and certainly we believe that the 2023 and 2024 cohort of SignalRank Index selections will be some of the best performing rounds for several years. The market is a buyers market, that much is clear.

Thanks to Peter Walker - On LinkedIn for his 2023 In Review | What happened in Series B this year?